Build Goal-Based Portfolios and Compliance Docs in Minutes. No Spreadsheets.

Investipal's AI analyzes client spending needs and generates optimized portfolios with liquidity bucketing, IPS documents, and Reg BI compliance—all in one workflow. Most planners complete full proposals in under 10 minutes.

Schedule a Demo

Trusted by advisory firms across North America

Transform Your Financial Planning Practice

From portfolio construction to compliance documentation, Investipal automates every step of your workflow so you can focus on what matters most—building lasting client relationships.

Build Personalized Portfolios in 5 Minutes

- AI analyzes spending sequences in seconds – Input estimated annual spending by year, and the AI determines optimal liquid vs. growth allocation across time horizons

- Customize or accept AI recommendations – Review the AI-generated portfolio, adjust if needed, or accept as-is. Most planners save 90% of portfolio construction time

- Include annuities and alternatives – Seamlessly allocate across equities, ETFs, mutual funds, private markets, and insurance products in one unified portfolio

Get Complete Client Data in Minutes, Not Days

- AI scans PDFs in 30 seconds – Upload brokerage statements, and our AI extracts every holding, allocation, and cost basis automatically. No manual data entry.

- Instant account aggregation – Connect to 15,000+ financial institutions. Sync checking, savings, investment, and retirement accounts in real-time.

- Run analysis in one click – Portfolio comparison, Monte Carlo simulation, tax transition analysis, and risk monitoring—all automated once data is in.

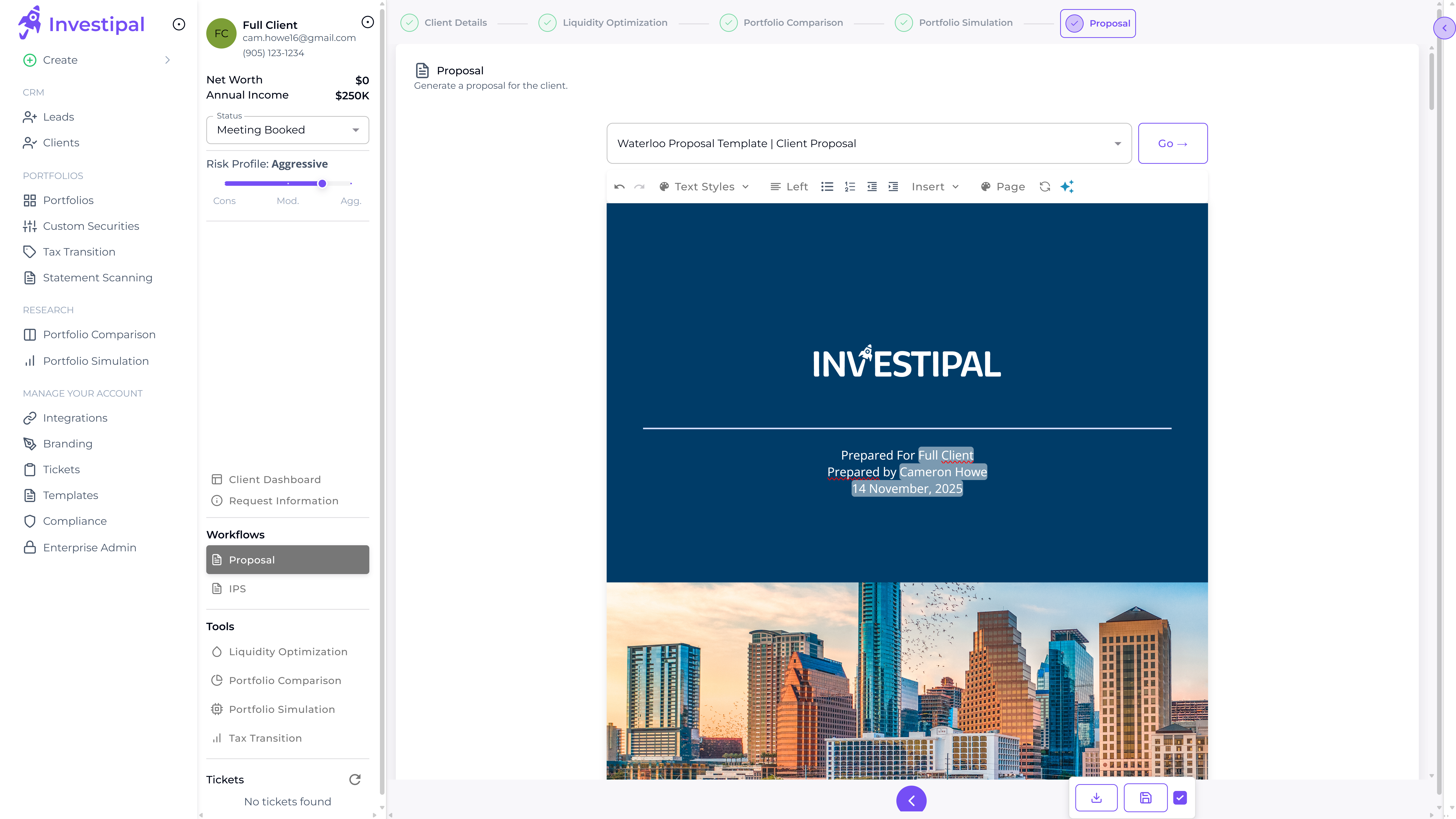

Generate Proposals and Compliance Docs in 2 Minutes

- One-click branded proposals – Turn your portfolio analysis into a professional, client-ready presentation with charts, projections, and recommendations. Customize the template once, then auto-generate for every client.

- Auto-generate IPS and Reg BI docs – Compliance documentation is created automatically from your portfolio data. No manual form-filling. Just review and send for e-signature.

- Built-in e-signature and tracking – Send proposals and compliance docs for e-signature directly from Investipal. Track opens, views, and signatures in real-time.

Spend more time advising and less time on admin

Free up your time to spend on higher-value activities.

Explore Our Key Features

Powerful tools designed specifically for financial planners

Statement Scanner

Extract and analyze client portfolio data from any statement format instantly

Portfolio Optimization

AI-powered asset allocation across public and alternative investments

Client Acquisition

Automate proposals, risk assessment, and prospect conversion

Risk Management

Real-time risk monitoring and automated portfolio rebalancing

Reg BI Compliance

Automated compliance documentation and disclosure generation

IPS Generator

Generate personalized Investment Policy Statements with AI

Frequently Asked Questions

Have questions? We have answers.

Investipal is AI-powered financial advisor software that automates portfolio construction, compliance documentation, and client onboarding. It's designed specifically for financial planners who want to spend less time on administrative work and more time with clients.

Most planners build complete portfolios in 5 minutes or less. You input the client's spending needs by year, and the AI generates optimal liquid/growth allocations with liquidity bucketing automatically. You can customize the output or accept it as-is.

Yes, absolutely. The AI provides recommendations based on the client's spending needs and risk tolerance, but you have full control to adjust allocations, change securities, or modify the strategy. Most advisors use the AI output as-is because it's accurate, but customization is always available.

Yes. You can allocate to your existing model portfolios OR individual securities. The AI determines the optimal allocation between liquid and growth assets, and you choose how to implement it—whether that's with your models, ETFs, mutual funds, or individual securities.

Upload a PDF brokerage statement, and our AI extracts every holding, allocation, and cost basis in about 30 seconds. No manual data entry required. The AI handles complex statements with hundreds of holdings, including alternatives and annuities.

Investipal auto-generates IPS (Investment Policy Statements) and Reg BI documentation from your portfolio analysis. The documents are pre-filled with client data, portfolio details, and disclosures. You just review, customize if needed, and send for e-signature.

Most firms are fully onboarded in 1-2 weeks. This includes setting up your branding, importing client data, configuring compliance templates, and training your team. We provide dedicated onboarding support to ensure a smooth transition.

Yes. Investipal integrates with major custodians (Schwab, Fidelity, TD Ameritrade, etc.) and CRMs (Salesforce, Redtail, Wealthbox, etc.). We also offer account aggregation that connects to 15,000+ financial institutions for held-away assets.

Pricing is based on the number of advisors and AUM. Contact us for a custom quote based on your firm's size and needs. Most planners save 15+ hours per week, which typically pays for the software many times over.

Yes. Investipal is SOC 2 Type II certified and uses bank-level encryption (256-bit AES). All data is encrypted in transit and at rest. We never sell or share client data with third parties. Your data is yours.

Enterprise-Grade Security

Your data is protected with bank-level security

Compliance & Privacy

Ensure adherence to SEC/FINRA standards with built-in compliance and privacy features. No user data is used in training.

Security

Investipal is SOC2 Type II compliant and all data is fully protected with advanced encryption and secure protocols.

Scalability

Grow through technology, not headcount.

"We're deeply committed to integrating cutting-edge technology to transform the financial planning and investment management landscape. Investipal's innovative approach aligns perfectly with our vision, particularly in utilizing OCR technology to streamline processes to elevate the client and advisor experience."

See Investipal in Action

Curious how Investipal can help accelerate your firm's growth? Chat with one of our solution experts.

Schedule a Demo