Standardize and Automate Your Entire Advisory Workflow. Firm-Wide.

AI-powered automation for every step: data intake, portfolio analysis, proposal generation, compliance documentation, and client onboarding. Standardize processes across all advisors while managing portfolios with equities, fixed income, alternatives, and annuities—without adding headcount.

Schedule a Demo

Trusted by advisory firms across North America

Drive Efficiency and Consistency Across Your Entire Firm

Eliminate operational bottlenecks and standardize best practices firm-wide. Investipal automates the complete advisory workflow—from initial data intake through signed advisory agreements—while managing portfolios across all asset classes including equities, fixed income, alternatives, and annuities.

Automate the Complete Advisory Workflow—From Intake to Onboarding

- Automated data intake and analysis – AI-powered statement scanning extracts holdings from any PDF in 30 seconds. Instant portfolio comparison, Monte Carlo simulation, and tax transition analysis—no manual data entry required.

- One-click proposal and compliance generation – Proposals, IPS documents, and Reg BI disclosures are auto-generated from analysis. Set firm-wide templates once, then every advisor produces consistent, compliant output in minutes.

- Digital onboarding and e-signature – Send advisory agreements, compliance documents, and proposals for e-signature directly from the platform. Track status in real-time. Complete onboarding in days, not weeks.

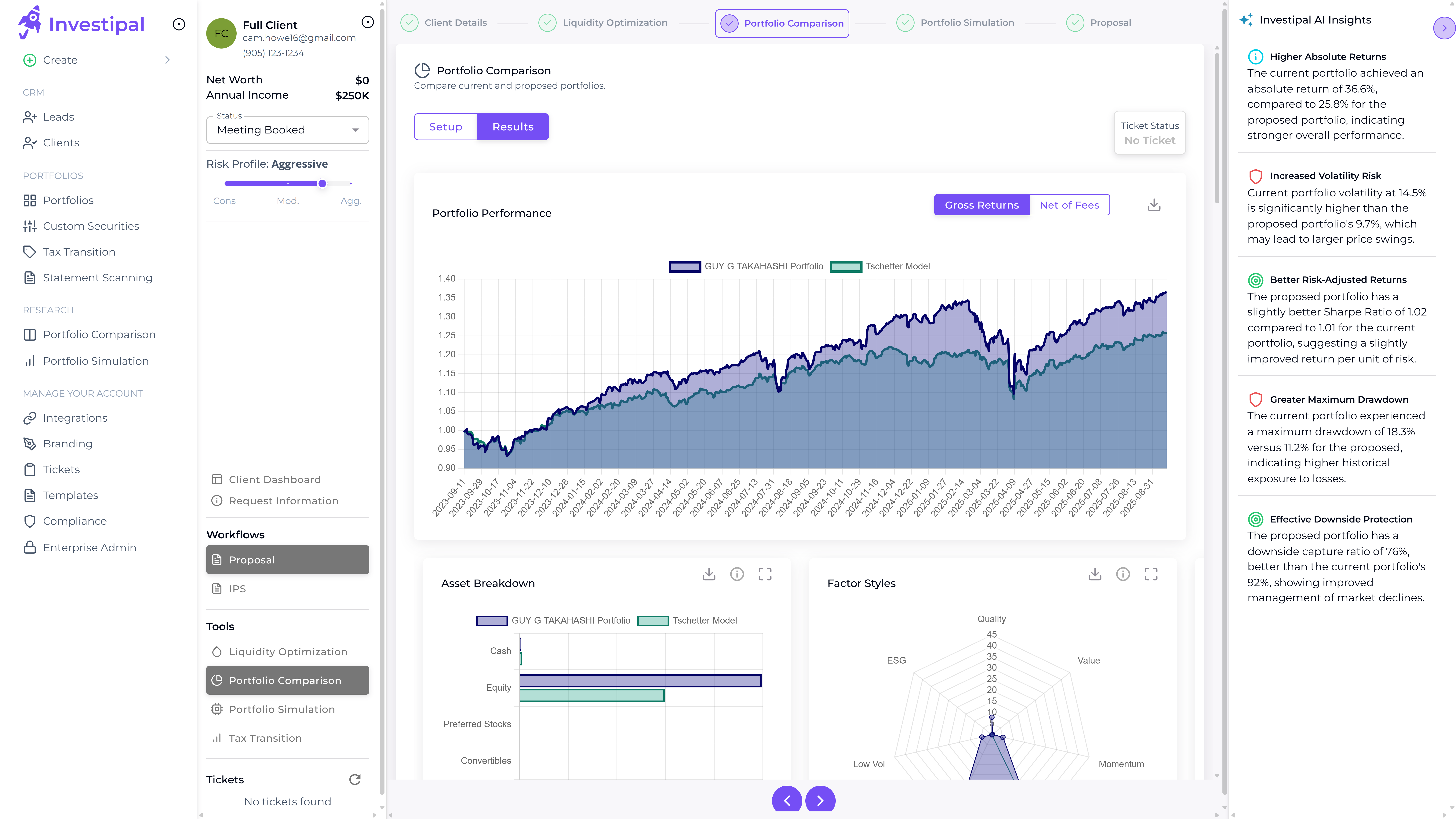

Multi-Asset Portfolio Construction and Analysis

- Multi-asset portfolio construction – Build portfolios with equities, fixed income, alternatives (PE, VC, real estate, private credit), and annuities. Access our database of private market securities with tracked performance metrics, or model custom alternatives if not in our database.

- Comprehensive portfolio analysis – Run portfolio comparison, Monte Carlo simulation, tax transition analysis, and risk assessment across all asset classes. Analyze risk/return profiles for both public and private securities in unified reports.

- Standardized methodologies with flexibility – Set firm-wide investment methodologies and model portfolios. Advisors can customize allocations and strategies for client needs while maintaining consistency with firm standards. AI-powered optimization for goal-based and risk-based strategies.

Automate Compliance and Risk Management Firm-Wide

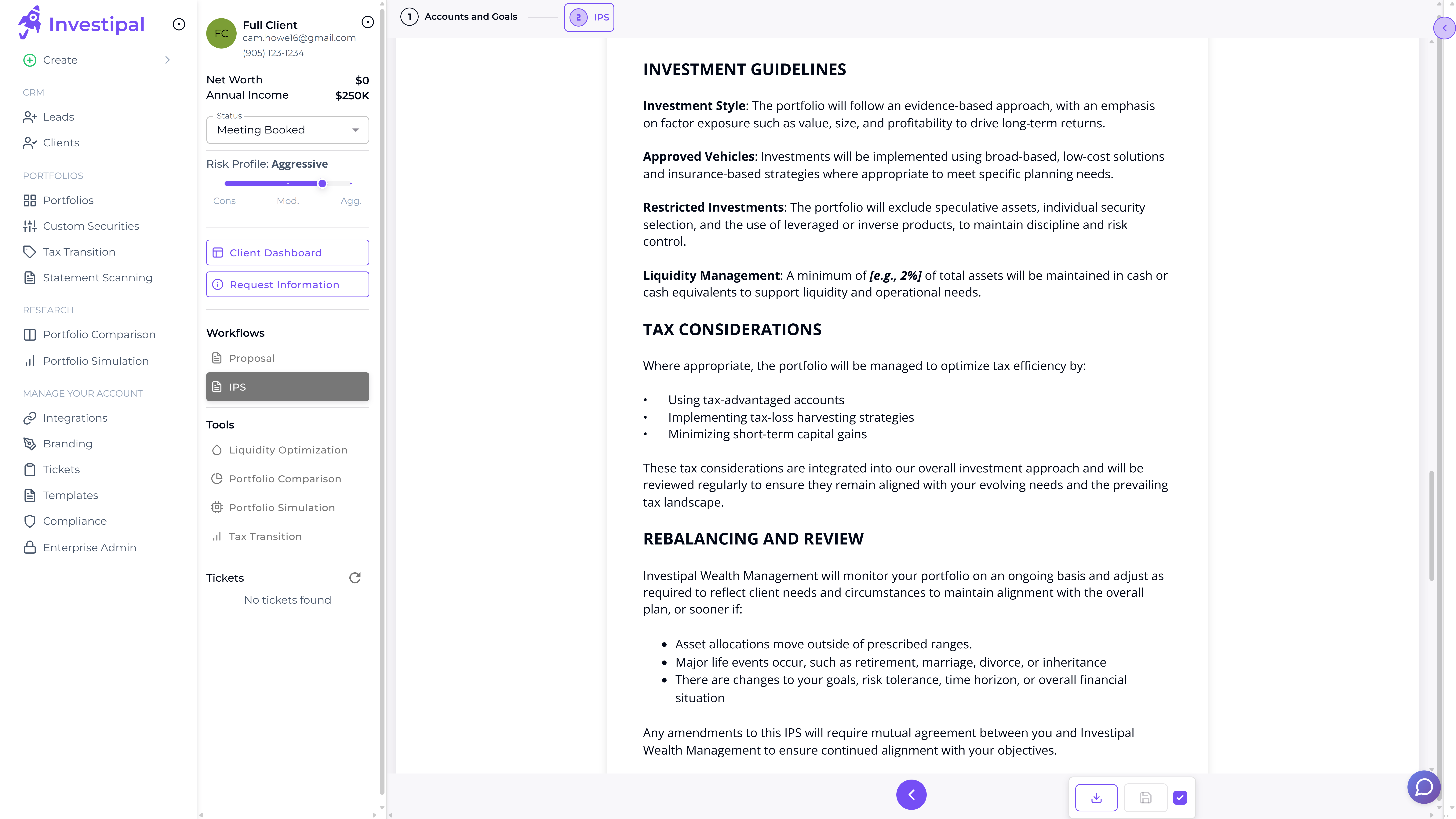

- Automated compliance documentation – IPS, Reg BI disclosures, and advisory agreements are auto-generated for every client from portfolio data. Set firm-wide compliance standards once, then enforce automatically. No advisor can skip required documentation.

- Real-time risk monitoring and alerts – Monitor drift, concentration risk, and compliance breaches across all portfolios 24/7. Set firm-wide thresholds and get instant alerts when any portfolio requires attention. Proactive risk management before issues escalate.

- Audit-ready reporting and documentation – Generate firm-wide compliance reports instantly for regulatory audits. Complete audit trails show every client action, document, and timestamp. Demonstrate compliance without manual paperwork gathering.

Spend more time advising and less time on admin

Free up your time to spend on higher-value activities.

Explore Our Key Features

Powerful tools designed specifically for wealth firms

Statement Scanner

Extract and analyze client portfolio data from any statement format instantly

Portfolio Optimization

AI-powered asset allocation across public and alternative investments

Client Acquisition

Automate proposals, risk assessment, and prospect conversion

Risk Management

Real-time risk monitoring and automated portfolio rebalancing

Reg BI Compliance

Automated compliance documentation and disclosure generation

IPS Generator

Generate personalized Investment Policy Statements with AI

Frequently Asked Questions

Have questions? We have answers.

Investipal automates the complete advisory workflow—from data intake through client onboarding—reducing advisor workload by 70%. Firms eliminate redundant tools, reduce manual work, and standardize processes firm-wide. Most firms see 40-60% faster client onboarding, 70% cost savings vs. their previous tech stack, and ROI within 3-6 months.

Investipal automates: (1) Data intake - AI scans statements and extracts holdings in 30 seconds, (2) Portfolio analysis - Automated portfolio comparison, Monte Carlo simulation, and tax analysis, (3) Proposal generation - One-click branded proposals with compliance disclosures, (4) Compliance documentation - Auto-generated IPS and Reg BI docs, (5) Client onboarding - E-signature for advisory agreements and compliance documents.

Set firm-wide standards for client intake, compliance templates, proposal branding, and investment methodologies. Advisors can then customize portfolios and strategies for their specific clients—but within your firm's guardrails. You get consistency where it matters (compliance, branding, risk management) and flexibility where it helps (portfolio customization, client communication).

Yes. Investipal supports multi-asset portfolio construction including equities, fixed income, alternatives (PE, VC, real estate, private credit), and annuities. Access our database of private market securities with risk/return/performance metrics, or model custom alternatives. Analyze portfolios across all asset classes with unified risk assessment, performance tracking, and portfolio comparison tools.

Investipal provides a centralized compliance dashboard showing every portfolio, drift alert, and compliance breach across all advisors. Set firm-wide drift thresholds and concentration limits once, then get real-time alerts when any portfolio needs attention. Every action is logged with timestamps for complete audit trails.

Comprehensive firm-wide visibility into all client portfolios and advisor activity. View portfolio performance, risk metrics, and asset allocation across all advisors. Track advisor productivity including proposals generated, clients onboarded, and compliance documentation completion rates. Monitor portfolio drift, concentration risk, and compliance status across the entire firm.

Most firms are fully onboarded in 2-4 weeks, depending on size and complexity. Implementation includes: firm branding setup, client data migration, advisor training, compliance template configuration, and integration with existing systems. We provide dedicated implementation support, weekly check-ins, and ongoing training for new advisors.

Investipal integrates with major custodians (Schwab, Fidelity, TD Ameritrade, Pershing), CRMs (Salesforce, Redtail, Wealthbox), and portfolio accounting systems (Black Diamond, Orion, Tamarac). Enterprise features include: SSO, role-based access control, audit logs, API access, custom reporting, and white-label branding.

Investipal is SOC 2 Type II certified with bank-level 256-bit AES encryption. We're FINRA and SEC compliant. All data is encrypted in transit and at rest. Enterprise security features include: SSO, role-based permissions, audit logs, IP whitelisting, and data residency options. Annual penetration testing and security audits.

Enterprise pricing is based on total firm AUM and number of advisors, with volume discounts for larger firms. Pricing includes unlimited client accounts, all features, integrations, dedicated support, and implementation services. Most firms see ROI within 3-6 months from operational efficiency gains alone. Contact us for a custom quote.

Enterprise-Grade Security

Your data is protected with bank-level security

Compliance & Privacy

Ensure adherence to SEC/FINRA standards with built-in compliance and privacy features. No user data is used in training.

Security

Investipal is SOC2 Type II compliant and all data is fully protected with advanced encryption and secure protocols.

Scalability

Grow through technology, not headcount.

"We're deeply committed to integrating cutting-edge technology to transform the financial planning and investment management landscape. Investipal's innovative approach aligns perfectly with our vision, particularly in utilizing OCR technology to streamline processes to elevate the client and advisor experience."

See Investipal in Action

Curious how Investipal can help accelerate your firm's growth? Chat with one of our solution experts.

Schedule a Demo