The average RIA spends 40% of their time on administrative tasks—time that could be spent building client relationships and growing their practice. Research from the 2025 Schwab RIA Benchmarking Study shows that firms investing 4.2-5% of revenue in technology see 16.6% AUM growth compared to just 12.1% for firms relying on manual workflows.

As you finalize your 2026 budget, technology isn’t just an operational expense—it’s a strategic growth lever. But with dozens of software options and limited budgets, which investments deliver real ROI? This guide breaks down the 7 technology investments that top-performing advisors are prioritizing for 2026, backed by industry benchmarks and ROI calculations you can take to your CFO.

Key Takeaways

- Industry benchmark: advisors should budget 3.8-4% of revenue for technology (top performers spend 4.2-5%)

- High-impact tools deliver 150-250% first-year ROI with payback periods of 4-12 months

- The average RIA spends 40% of time on administrative tasks—technology can cut this in half

- 67% of advisors now use integrated tech stacks vs 48% in 2022, reflecting industry shift toward consolidation

- Priority investments for 2026: AI-powered proposal automation, integrated CRM, and portfolio management platforms

How Much Are Financial Advisors Actually Spending on Technology?

Before we dive into specific investments, let’s establish realistic budget benchmarks based on industry data.

According to the 2024 InvestmentNews Advisor Benchmark Study, technology spending averages 3.8% of firm revenue, with top-performing firms investing 4.2-5% of revenue. The 2025 Schwab RIA Benchmarking Study confirms this trend, revealing that firms with higher tech spending saw 16.6% AUM growth compared to 12.1% for firms with manual workflows.

Technology Spending by Firm Size

Here’s what you should expect to spend based on your firm’s scale:

Solo Advisor ($0-$100M AUM, 50-75 clients):

- Annual tech budget: $6,000-$10,000 ($500-$833/month)

- Cost per client: $80-$133/year

- Primary focus: Core workflow automation

Small RIA ($100M-$500M AUM, 2-5 advisors, 150-300 clients):

- Annual tech budget: $24,000-$45,000 ($2,000-$3,750/month)

- Cost per advisor: $8,000-$12,000/year

- Primary focus: Team collaboration and client scalability

Mid-Size RIA ($500M-$2B AUM, 5-15 advisors, 300-800 clients):

- Annual tech budget: $75,000-$150,000 ($6,250-$12,500/month)

- Cost per advisor: $10,000-$15,000/year

- Primary focus: Operational efficiency and compliance automation

Large RIA ($2B+ AUM, 15+ advisors, 800+ clients):

- Annual tech budget: $200,000-$500,000+ ($17,000-$42,000/month)

- Cost per advisor: $12,000-$20,000/year

- Primary focus: Enterprise integration and advanced analytics

The key insight: Top-performing firms view technology as a growth investment, not a cost center. Research from Kitces Research shows that 67% of advisors now use integrated technology stacks rather than stand-alone solutions, up from 48% in 2022.

The Hidden Cost of Not Investing

Research shows that the average RIA spends nearly 40% of their time on administrative tasks. For an advisor billing at $200/hour, that’s $80,000 in annual time spent on non-revenue-generating activities. The right technology can cut this admin burden by 50%, freeing up 800+ hours per year for client relationships and business development.

The Financial Advisor’s Framework for Calculating Technology ROI

Before investing in any technology, you need a clear framework for calculating expected returns. Here are three proven methods:

Method 1: Time Savings ROI

Formula: (Hours saved per year × Hourly rate) - Annual software cost = Net benefit

Example: A 3-advisor RIA invests in proposal automation software:

- Proposal time: 45 minutes → 10 minutes (35 minutes saved)

- Proposals per year: 60

- Total time saved: 35 hours/year

- Hourly rate: $200

- Value of time saved: $7,000

- Software cost: $450/month = $5,400/year

- Net ROI: $1,600 (30% ROI on time savings alone)

But the real value comes from capacity expansion…

Method 2: Revenue Impact ROI

Formula: (New AUM acquired × Fee rate × Attribution %) - Software cost = Net benefit

Continuing the example above, the faster proposal process allows the firm to:

- Take on 8 additional clients (capacity freed up)

- Average new client AUM: $500K

- New AUM: $4M

- Fee rate: 1%

- Annual revenue: $40,000 in new revenue

Combined ROI: ($7,000 time savings + $40,000 new revenue - $5,400 cost) / $5,400 = 770% ROI

Method 3: Efficiency ROI

Formula: (Cost per transaction × Transaction volume × Improvement %) - Software cost = Net benefit

Research from Mako FinTech shows that manual form processing costs $60 in fully loaded costs (staff time, error correction, follow-ups), while digital onboarding reduces this to under $5 per form.

Example: A firm processing 200 new client forms annually:

- Manual cost: 200 × $60 = $12,000

- Digital cost: 200 × $5 = $1,000

- Annual savings: $11,000

- Software cost: $6,000/year

- Net benefit: $5,000 (83% ROI)

Qualitative Factors to Consider

Not all ROI is measurable in dollars. Consider these qualitative benefits:

- Client satisfaction scores (firms with client portals see 20% higher satisfaction)

- Error reduction (automated workflows reduce data entry errors by 70%)

- Compliance risk mitigation (automated audit trails and documentation)

- Team morale (less time on tedious tasks = higher job satisfaction)

- Competitive positioning (78% of clients now expect digital experiences)

7 Technology Investments Financial Advisors Should Prioritize for 2026

Based on industry trends, ROI potential, and 2026 planning priorities, here are the seven technology investments that should be at the top of your list:

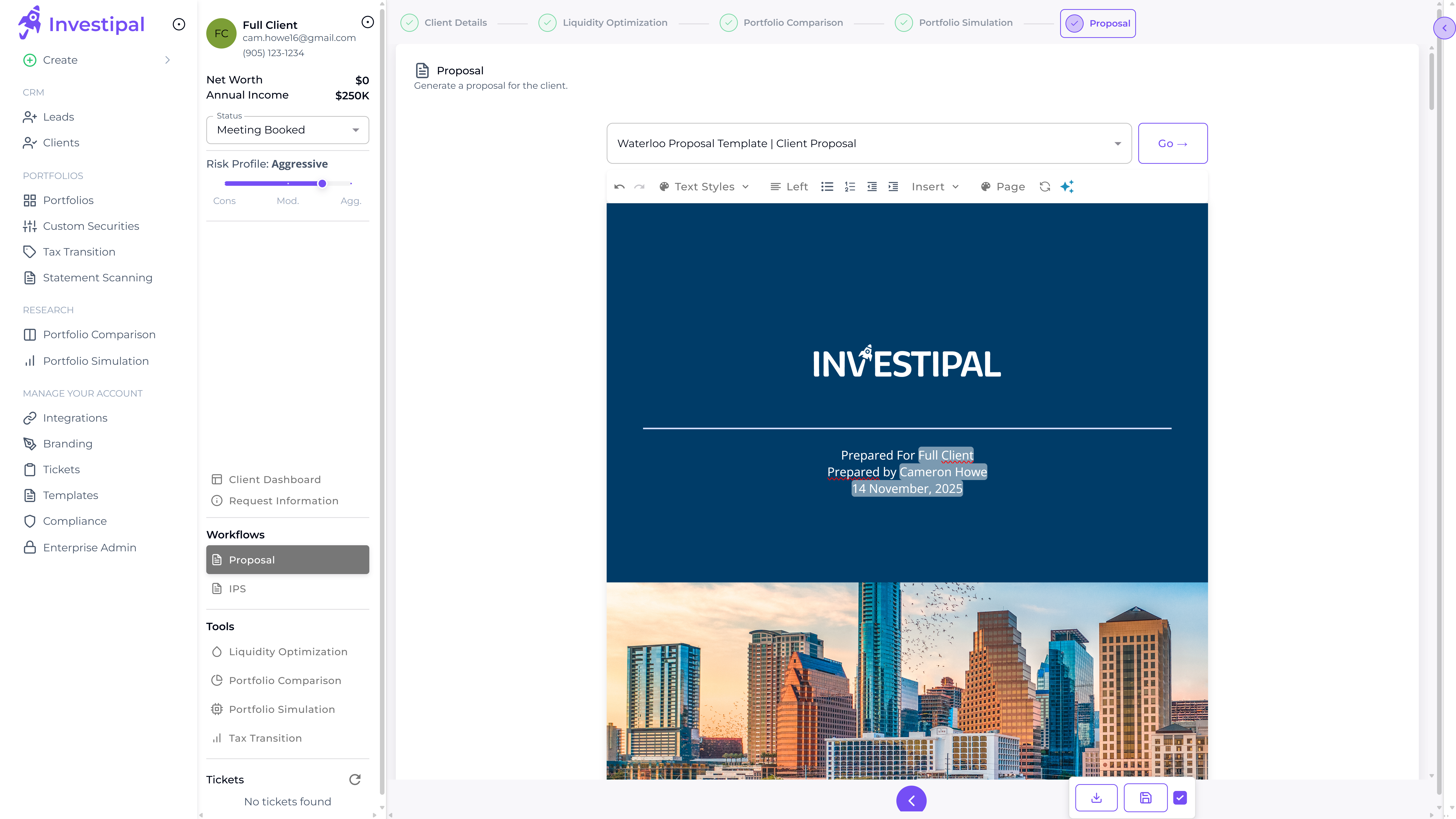

1. AI-Powered Proposal Automation: From 45 Minutes to 10 Minutes

What it is: Software that generates investment proposals from client data, risk profiles, and current holdings, automating the entire proposal workflow from statement upload to compliant documentation.

Why it matters in 2026: The 2025 Schwab RIA Benchmarking Study found that 78% of firms are hiring to meet capacity constraints—but quality talent is scarce. Proposal automation provides an alternative path to scaling without adding headcount.

Expected ROI:

- Typical time reduction: 35-40 minutes per proposal

- For 60 proposals/year: 40+ hours reclaimed

- Value at $200/hour: $8,000

- Capacity for 10-15 more clients: $50,000-$75,000 potential revenue

- Typical first-year ROI: 150-250%

- Payback period: 4-6 months

Key features to demand:

- Automated statement scanning with OCR technology supporting 50+ custodian formats

- Integrated risk assessment that flows into portfolio recommendations

- Compliance documentation including IPS and Reg BI disclosures generated automatically

- Portfolio comparison tools showing current vs proposed allocations with clear visualizations

- Customizable templates that maintain your brand while automating the heavy lifting

Budget range: $250-$1,200/month depending on features and firm size (note: all-in-one platforms that consolidate multiple tools often cost less than the combined pricing of separate point solutions)

Priority level: Year 1 - Critical (highest ROI, fastest payback period)

Industry benchmark: Firms using integrated proposal automation reduce time-to-proposal by 75-80%, freeing up significant capacity for client acquisition. The time savings translate directly to either higher advisor productivity or the ability to serve more clients without additional headcount.

Investipal consolidates the entire proposal workflow: Our platform combines statement scanning, risk assessment, portfolio optimization, and compliance documentation in a single workflow. Advisors generate compliant proposals in under 10 minutes in typical workflows (subject to advisor review and data quality).

2. Integrated CRM: The Foundation of Your Tech Stack

What it is: A client relationship management system that connects all client touchpoints—from initial prospect contact through ongoing service—in a single platform.

Why it matters in 2026: The industry trend toward platform consolidation is accelerating. According to Investment Trends’ 2025 Adviser Technology Needs Report, the average number of platforms has dropped from 2.2 to 2.0, with 71% of new client flows directed to advisors’ primary platform. Firms with fragmented systems are losing efficiency and falling behind.

Expected ROI:

- Reduces manual data entry by 70%

- Automates 30-40% of follow-up tasks

- Eliminates duplicate data across systems

- Typical time savings: 10-15 hours/month per advisor

- Payback period: 6-8 months

Key features to demand:

- Native integrations (not just APIs) with your custodian, portfolio management, and planning software

- Workflow automation for meeting preparation, follow-ups, and task management

- Client portal connectivity for document sharing and secure communication

- Compliance archiving capturing emails, documents, and client communications

- Mobile accessibility for advisors working remotely or meeting with clients off-site

- Customizable fields to capture data specific to your practice

Budget range: $100-$300/user/month

Priority level: Year 1 - Essential (foundation layer for all other integrations)

Popular options: Redtail Technology ($99/month unlimited users), Wealthbox ($45-$319/month by tier), or Salesforce Financial Services Cloud ($225+/user) for firms requiring advanced customization.

Learn more about optimizing your advisor tech stack for maximum efficiency.

3. Portfolio Management Software: Automate Rebalancing and Reporting

What it is: Platforms that manage portfolio construction, rebalancing, performance reporting, and fee billing in an integrated workflow.

Why it matters in 2026: With organic growth being critical to success (top performers achieved 12.5% organic growth vs 6% overall, according to Schwab), advisors need capacity to manage more AUM per advisor without sacrificing service quality.

Expected ROI:

- Saves 20 hours/month on performance reporting

- Reduces rebalancing time by 90%

- Automates fee billing calculations

- Typical time savings: 240 hours/year

- Value: $48,000+ at $200/hour billing rate

- Payback period: 6-10 months

Key features to demand:

- Automated rebalancing with customizable drift thresholds and tax-aware optimization

- Custom benchmark creation to show performance against relevant comparisons

- Multi-custodian aggregation for complete portfolio visibility

- Tax-aware rebalancing identifying tax-loss harvesting opportunities

- Performance attribution reporting showing the impact of decisions

- Model portfolio management for efficiently managing multiple client segments

- Integrated billing automating fee calculations and invoicing

Budget range: $1,000-$5,000/month depending on AUM and feature complexity

Priority level: Year 1-2 (essential for firms managing $100M+ AUM; can wait for smaller practices)

Capacity impact: Firms with automated rebalancing typically manage 50-75% more AUM per advisor compared to manual processes, according to industry benchmarks.

Investipal’s AI-driven portfolio optimization analyzes risk, cost, and tax efficiency to recommend data-backed rebalancing actions, with built-in compliance documentation for each recommendation.

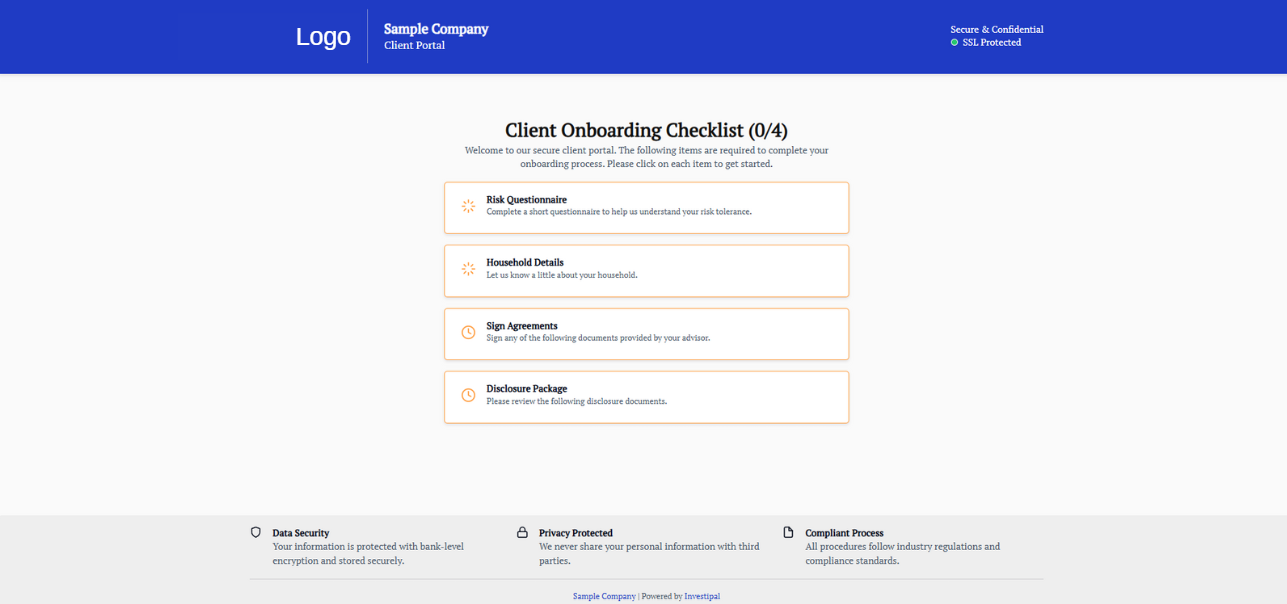

4. Digital Client Onboarding: Reduce $60/Form Costs to Under $5

What it is: End-to-end digital client onboarding platforms with e-signature, ID verification, AML checks, and automated data collection workflows.

Why it matters in 2026: According to Schwab’s research, 78% of clients now expect interactive digital experiences from their financial advisors. Manual onboarding creates NIGOs (not in good order), delays account opening, and damages the critical first impression with new clients.

Expected ROI:

- Reduce per-form processing from $60 to under $5

- Cut onboarding time from 5 days to 1 day

- Eliminate 90% of NIGOs caused by data entry errors

- For 50 new clients/year: $2,750 savings

- Plus improved conversion rates (faster onboarding = less prospect drop-off)

- Payback period: 8-12 months

Key features to demand:

- E-signature integration (DocuSign, Adobe Sign) embedded in workflow

- ID scanning and verification with facial recognition

- Automated AML/KYC checks with real-time screening

- Risk tolerance questionnaires that feed into portfolio recommendations

- Document collection workflows with automated reminders for missing items

- CRM integration so data flows seamlessly without re-entry

Budget range: $300-$1,000/month plus per-signature fees (typically $0.50-$1.50/signature)

Priority level: Year 1-2 (essential for growth-focused firms; nice-to-have for mature practices)

Client experience impact: Firms with digital onboarding see 20-30% higher client satisfaction scores and significantly lower drop-off rates during the account opening process.

Investipal’s digital onboarding: Our platform streamlines client onboarding with automated data collection, risk questionnaires, and document workflows—all integrated with proposal generation so client data flows seamlessly from onboarding through portfolio recommendations.

Read our complete guide on automating client onboarding workflows for step-by-step implementation.

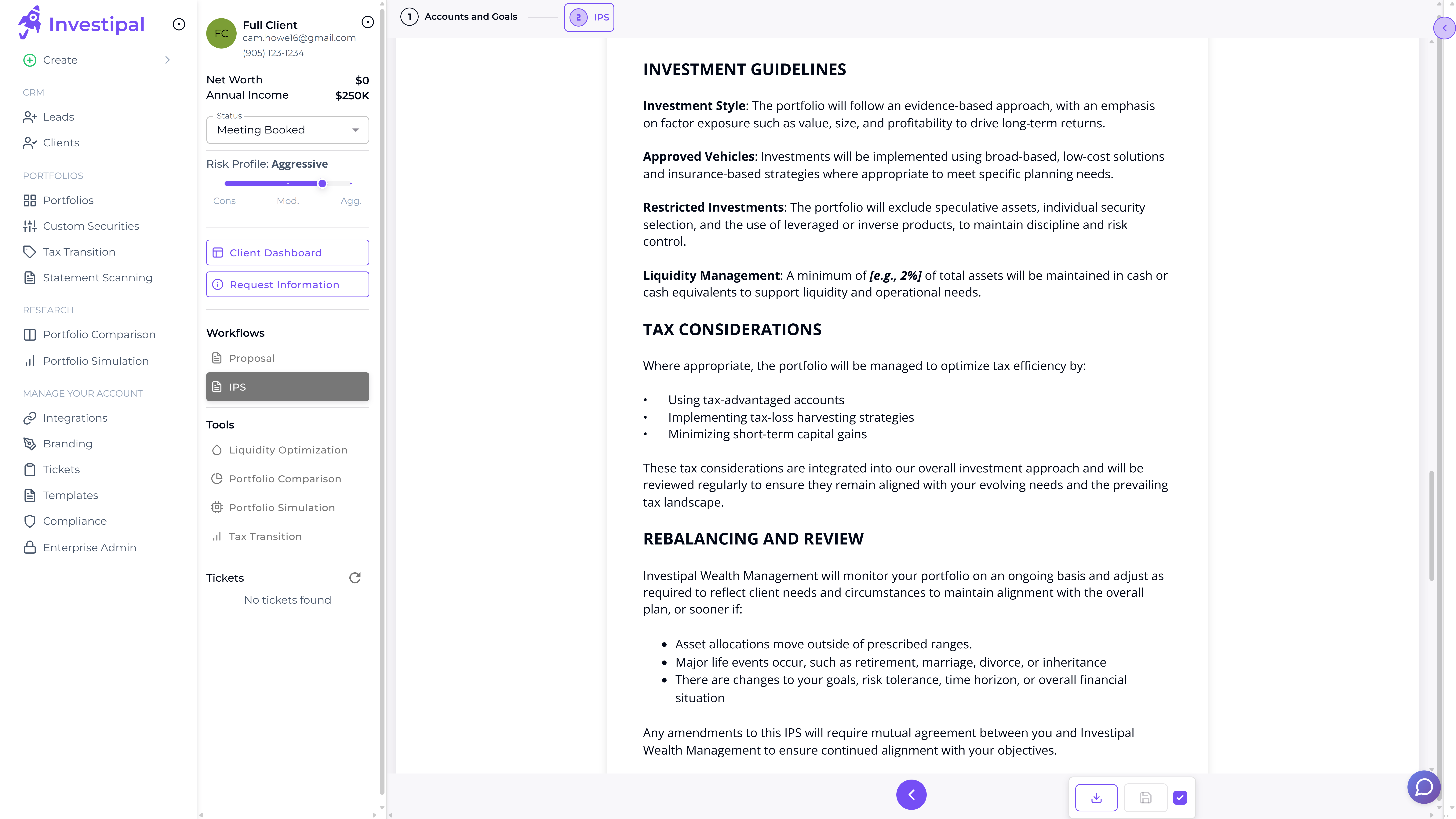

5. Compliance Automation: Generate IPS and Reg BI Docs in Minutes

What it is: Software that automates Investment Policy Statement creation, Reg BI disclosures, compliance reporting, and audit trail documentation.

Why it matters in 2026: According to Forrester’s 2026 IT Budget Planning Guide, 80% of AI use cases fail due to lack of governance—making compliance-first automation a strategic priority. With increasing regulatory scrutiny and staffing constraints, automated compliance is becoming table stakes.

Expected ROI:

- Reduces IPS creation from 2 hours to 2 minutes (subject to advisor review)

- Saves 95% of time on compliance documentation

- Reduces compliance staff burden by 40%

- Typical time savings: 100+ hours/year

- Risk mitigation value: Difficult to quantify but substantial (one compliance violation can cost $50K-$500K)

- Payback period: 10-14 months

Key features to demand:

- Automated IPS generation from client data, risk profiles, and investment strategy

- Reg BI disclosure automation with best interest analysis documentation

- Audit trail and documentation for all client interactions and portfolio decisions

- Compliance monitoring and alerts for drift, concentration, or risk threshold breaches

- Trade surveillance identifying potential conflicts or unsuitable recommendations

- Email and communication archiving for regulatory compliance

Budget range: $500-$2,000/month depending on firm size and regulatory requirements

Priority level: Year 2 (unless facing compliance issues or rapid growth)

Compliance note: Investipal auto-generates Investment Policy Statement documents alongside proposals, reducing what was traditionally a 2-hour task to under 2 minutes (subject to advisor review). Features assist documentation; they are not legal advice.

Learn more about automated Reg BI compliance workflows.

6. Financial Planning Software with AI Analysis

What it is: Comprehensive financial planning platforms with AI-powered scenario analysis, goal-based planning, and interactive client portals.

Why it matters in 2026: Research from Fintech Global shows that 64% of financial advisors are prioritizing investments in personalized client experiences. AI-enhanced planning software allows you to deliver highly customized plans at scale.

Expected ROI:

- Reduces planning time by 30-40%

- Enables 10x more scenario modeling per plan

- Improves client engagement through interactive portals

- Typical time savings: 15-20 hours/month

- Capacity for 10-15 more planning clients/year

- Payback period: 6-9 months

Key features to demand:

- Goal-based planning modules (retirement, education, major purchases)

- Monte Carlo simulation showing probability of success under different scenarios

- Tax planning tools identifying optimization opportunities

- Estate planning integration with document generation

- Client-facing portals for real-time plan access and scenario modeling

- AI-powered scenario suggestions identifying planning opportunities

Budget range: $150-$500/user/month

Priority level: Year 1-2 (core service delivery tool for planning-focused practices)

Popular platforms: eMoney Advisor, RightCapital, MoneyGuidePro, and Advicent NaviPlan are widely used solutions with strong track records.

7. Account Aggregation: The 360° Client View

What it is: Technology that aggregates held-away accounts, bank data, and investment accounts from multiple custodians into a single comprehensive view.

Why it matters in 2026: Cerulli Associates’ 2024 research found that data aggregation is the #1 factor advisors consider when selecting technology. Clients hold an average of 2.8 financial relationships—without aggregation, you’re flying blind on 60-70% of their wealth.

Expected ROI:

- Identifies 30-40% more AUM opportunities through visibility to held-away assets

- Reduces time spent chasing account statements

- Enables holistic financial planning

- For $500M AUM firm capturing 20% more assets: $1M additional AUM = $10K annual revenue (at 1% fee)

- Payback period: 12-18 months

Key features to demand:

- API-based aggregation (not just screen scraping) for reliability and speed

- Bank-level security with multi-factor authentication

- Real-time balance updates (not weekly batch updates)

- Support for alternative assets (private equity, real estate, crypto)

- Multi-custodian connectivity covering all major firms

- Data quality validation to catch errors before they impact reporting

Budget range: $300-$1,000/month depending on number of connections and data volume

Priority level: Year 2-3 (value-add for existing clients; not mission-critical for startups)

Client retention impact: Advisors with comprehensive account visibility report 25-30% higher client retention rates, as they’re able to identify and address financial planning gaps proactively.

Investipal’s automated statement scanner works with 50+ custodian formats, extracting held-away data from PDF statements in seconds using AI-powered OCR technology (depending on data quality and statement format).

Building Your Realistic 2026 Technology Budget

Now that we’ve covered the seven priority investments, let’s translate this into actionable budgets by firm size.

Budget Template: Solo Advisor ($0-$100M AUM)

Year 1 Essential Stack: $5,100-$6,600/year ($425-$550/month)

| Technology | Monthly Cost | Annual Cost | Priority |

|---|---|---|---|

| CRM (Redtail or Wealthbox Solo) | $100 | $1,200 | Critical |

| Investipal All-In-One Platform* | $250 | $3,000 | Critical |

| Financial Planning Software | $200 | $2,400 | High |

| Total Year 1 | $550 | $6,600 | - |

*Investipal includes: Data intake/statement scanning, proposal generation, client onboarding, risk assessment, portfolio design (including alternative investments), portfolio optimization, and compliance documentation (IPS generation)

Expected first-year returns:

- Time savings: 35-50 hours = $7,000-$10,000 value

- Capacity for 8-10 more clients = $40,000-$50,000 potential revenue

- ROI: 600-750%

- Payback period: 1-2 months

Year 2 additions:

- Portfolio management: $200-$400/month

- Digital onboarding: $100-$200/month

- Year 2 total: $1,140-$1,440/month

Budget Template: Small RIA ($100M-$500M AUM, 2-5 advisors)

Year 1 Comprehensive Stack: $18,000-$30,000/year ($1,500-$2,500/month)

| Technology | Monthly Cost | Annual Cost | Priority |

|---|---|---|---|

| CRM (Wealthbox Pro) | $300 | $3,600 | Critical |

| Investipal All-In-One Platform* | $250 | $3,000 | Critical |

| Portfolio Management | $1,500 | $18,000 | Critical |

| Financial Planning (3 users) | $600 | $7,200 | High |

| Digital Onboarding (if needed) | $300 | $3,600 | Medium |

| Total Year 1 | $2,950 | $35,400 | - |

*Investipal includes: Data intake/statement scanning, proposal generation, client onboarding, risk assessment, portfolio design (including alternative investments), portfolio optimization, and compliance documentation (IPS generation)

Expected first-year returns:

- Time savings: 200+ hours = $40,000-$60,000 value

- Capacity for 20-30 more clients = $100,000-$150,000 potential revenue

- Reduced processing costs: $10,000-$15,000

- ROI: 400-500%

- Payback period: 2-4 months

Budget Template: Mid-Size RIA ($500M-$2B AUM, 5-15 advisors)

Year 1 Enterprise Stack: $75,000-$150,000/year ($6,250-$12,500/month)

| Technology | Monthly Cost | Annual Cost | Priority |

|---|---|---|---|

| CRM (10 users) | $1,500 | $18,000 | Critical |

| Proposal & Client Acquisition Tools | $750-$1,500 | $9,000-$18,000 | Critical |

| Portfolio Management | $4,000 | $48,000 | Critical |

| Financial Planning (10 users) | $2,000 | $24,000 | Critical |

| Digital Onboarding | $1,000 | $12,000 | Critical |

| Compliance Suite | $2,000 | $24,000 | High |

| Account Aggregation | $800 | $9,600 | Medium |

| Total Year 1 | $12,800 | $153,600 | - |

Expected first-year returns:

- Time savings: 800+ hours = $160,000+ value

- Capacity for 15-20% AUM growth = $75M-$150M potential

- At 1% fee = $750,000-$1.5M incremental revenue (over 3-5 years)

- Reduced operational costs: $50,000-$75,000

- ROI: 400-600%

- Payback period: 2-4 months

Investment Prioritization: What to Buy When

Not every firm should implement all seven technologies simultaneously. Here’s a prioritization framework based on firm stage and goals:

Year 1 Critical Investments (Must-Have for All Firms)

- Integrated CRM - Foundation layer; nothing works without this

- Proposal Automation - Highest ROI, fastest payback

- Financial Planning Software - Core service delivery tool

Rationale: These three create the foundation for efficient client service and have the shortest payback periods (4-8 months).

Year 1 High Priority (For Growing Firms)

- Portfolio Management - Essential once AUM exceeds $100M

- Digital Onboarding - Critical for firms adding 20+ clients/year

Rationale: These support scalability and capacity but can wait if you’re still building your client base.

Year 2 Medium Priority (Optimization Layer)

- Compliance Automation - Reduces risk and staff burden

- Account Aggregation - Enhances existing client relationships

Rationale: These add significant value but aren’t blocking factors for growth. Implement once core operations are running smoothly.

Common Mistakes to Avoid

1. Buying before defining workflows

- Tool-first thinking leads to mismatched solutions

- Map your ideal workflow FIRST, then find tools that fit

- Example: Don’t buy 5 point solutions when an integrated platform would eliminate data re-entry

2. Underestimating implementation time

- Budget 20-30% of software cost for training and onboarding

- Implementation takes 2-3x longer than vendors quote

- Factor in 4-8 weeks of reduced productivity during transition

3. Choosing cheapest option instead of best fit

- Total Cost of Ownership includes training, integration, support

- A $50/month tool requiring 10 hours of manual work costs MORE than a $500/month automated solution

- Calculate: (Monthly cost + (hours saved × hourly rate)) = true cost

4. Failing to negotiate

- Most vendors offer 15-30% discount for annual prepayment

- Multi-year contracts can save 25-40%

- Bundle deals across same vendor’s products

- Q4 is great negotiating time (vendors want to hit targets)

5. Ignoring integration requirements

- ”API available” doesn’t mean it works well in practice

- Test integrations during demo/trial period

- Get integration documentation before signing contracts

- Demand examples from other clients using same integration

How Investipal Consolidates Multiple Investments Into One Platform

One of the biggest challenges advisors face is managing multiple disconnected tools. Data re-entry, broken integrations, and tool-switching waste valuable time.

Investipal addresses this by consolidating five technology investments into a single integrated workflow:

Traditional Fragmented Tech Stack:

- Statement aggregation/data intake: $400/month

- Risk assessment tool: $300/month

- Proposal generation software: $500/month

- Digital onboarding platform: $300/month

- IPS/compliance generator: $200/month

- Total: $1,700/month = $20,400/year

Investipal All-In-One Platform: $250/month

Our integrated workflow includes all features in one platform:

Step 1: Upload Client Statement

AI-powered OCR extracts portfolio data from 50+ custodian formats in seconds (depending on data quality)

Step 2: Assess Risk Tolerance Automated risk questionnaire flows directly into portfolio recommendations

Step 3: Design & Optimize Portfolio AI-driven portfolio builder helps design portfolios (including alternative investments like REITs, structured products, and other alts) and analyzes risk, cost, and tax efficiency

Step 4: Create Proposal + IPS

Single-click generation of compliant proposal with automated IPS documentation

Total time in typical workflows: Under 10 minutes (subject to advisor review and data quality)

Platform cost: $250/month for all features—that’s 85% less than using separate tools ($1,700/month)

Annual savings: $17,400/year by consolidating to one platform

By consolidating these workflows, advisors eliminate:

- Manual data re-entry between systems

- Integration breakdowns and error reconciliation

- Tool-switching and context-shifting

- Duplicate subscription costs

- Multiple vendor relationships and training requirements

Book a demo to see the complete workflow in action.

Learn more about how integrated platforms reduce tech stack fragmentation.

Your 90-Day Technology Implementation Roadmap

Successfully implementing new technology requires a phased approach. Here’s a proven 90-day roadmap:

Weeks 1-4: Foundation Layer

Goals: Implement CRM and migrate critical data

Tasks:

- Set up user accounts and permissions

- Migrate client data from existing systems

- Configure workflows and automations

- Conduct initial team training (3-5 hours)

- Document new processes

Success metric: All client data accessible in CRM with no regressions

Weeks 5-8: Core Operations

Goals: Add proposal automation and financial planning

Tasks:

- Connect proposal software to CRM

- Integrate financial planning platform

- Train team on new proposal workflow (5-8 hours)

- Create proposal templates

- Generate first 5-10 client proposals

Success metric: Proposal creation time reduced by 50%+

Weeks 9-12: Optimization and Expansion

Goals: Integrate portfolio management and compliance tools

Tasks:

- Connect portfolio management platform

- Set up automated rebalancing rules

- Implement compliance documentation workflows

- Conduct advanced training sessions

- Measure and report ROI to stakeholders

Success metric: All core workflows automated; team confident with tools

Success Metrics to Track

| Metric | Baseline | 90-Day Target | 12-Month Target |

|---|---|---|---|

| Proposal creation time | 45 min | 15 min | 10 min |

| Client onboarding time | 5 days | 2 days | 1 day |

| Admin time % | 40% | 25% | 20% |

| Data entry errors | 15/month | 5/month | 2/month |

| Clients per advisor | 60 | 70 | 80 |

| Technology ROI | N/A | 100%+ | 200%+ |

Frequently Asked Questions About Advisor Technology Budgets

How much should a financial advisor spend on technology?

Financial advisors should budget 3.8-4% of firm revenue for technology, according to industry benchmarks from the 2024 InvestmentNews Advisor Benchmark Study. Top-performing firms invest 4.2-5% of revenue and see measurably higher growth rates. Cost per advisor typically ranges from $8,000-$12,000/year for an integrated tech stack.

Solo advisors managing $50-100M AUM should budget $6,000-$10,000 annually, while mid-size RIAs ($500M-$2B AUM) typically invest $75,000-$150,000/year across their technology infrastructure.

What’s the average ROI for advisor technology investments?

High-impact tools like proposal automation and CRM systems typically deliver 150-250% first-year ROI with payback periods of 4-12 months. The 2025 Schwab RIA Benchmarking Study found that firms with integrated tech stacks saw 16.6% AUM growth compared to 12.1% for firms with manual workflows.

ROI compounds over time as advisors gain efficiency and capacity to serve more clients. Second-year ROI often exceeds 300-500% as implementation costs drop and benefits fully materialize.

Should I buy an all-in-one platform or best-of-breed tools?

The industry trend strongly favors platform consolidation. Investment Trends’ 2025 research shows the average number of platforms has dropped from 2.2 to 2.0, with 71% of new client flows directed to advisors’ primary platform.

All-in-one advantages: Easier integration, single support relationship, lower total cost, consistent user experience

Best-of-breed advantages: More features per category, flexibility to optimize each function

Hybrid approach (recommended): Core integrated platform (CRM + proposal + planning) supplemented with specialized tools for specific needs. This balances integration benefits with functional depth.

How do I calculate technology ROI for my specific firm?

Use this three-factor framework:

1. Time Savings: (Hours saved per year × Your hourly rate) - Software cost

2. Revenue Impact: (New AUM capacity × Fee rate) - Software cost

3. Cost Reduction: (Current process cost - New process cost) × Volume - Software cost

Example calculation: $18,000/year proposal software investment

- Time saved: 35 hours × $200/hour = $7,000

- New client capacity: 8 clients × $500K AUM × 1% fee = $40,000

- Total benefit: $47,000

- Net ROI: ($47,000 - $18,000) / $18,000 = 161%

Don’t forget qualitative factors: error reduction, compliance risk mitigation, client satisfaction improvements, and team morale.

What technology should I prioritize with a limited budget?

If budget is constrained, prioritize in this order:

1. Integrated CRM ($100-$300/month) - Foundation for everything else 2. Proposal automation ($500-$800/month) - Highest ROI and fastest payback 3. Financial planning software ($150-$300/month) - Core service delivery

These three investments have 4-8 month payback periods and create immediate capacity for growth. Defer portfolio management, compliance automation, and aggregation tools until Year 2 when cash flow improves.

Many vendors offer startup pricing or monthly payment plans to reduce upfront investment. Request these when negotiating contracts.

How long does it take to implement new advisor technology?

Implementation timelines vary by technology complexity:

- CRM: 4-8 weeks (data migration is the bottleneck)

- Proposal automation: 2-4 weeks (relatively quick)

- Portfolio management: 6-12 weeks (custodian integrations take time)

- Full integrated stack: 3-6 months (phased rollout recommended)

Budget 20-30% of software costs for training and expect a 4-8 week productivity dip during transition. Teams need time to learn new workflows before efficiency gains materialize.

Pro tip: Don’t implement everything simultaneously. Phase rollouts over 90 days to avoid overwhelming your team.

Can I negotiate better pricing on advisor software?

Yes—most advisor software vendors are open to negotiation:

Effective negotiation tactics:

- Request 15-30% discount for annual prepayment (vs monthly)

- Negotiate multi-year contracts for 25-40% savings

- Ask about bundle pricing if buying multiple products

- Time purchases for Q4 (vendors want to hit year-end targets)

- Mention competitive quotes to create urgency

- Request startup pricing if you’re a new firm

- Ask about enterprise discounts at 5+ users

What vendors want: Annual contracts (predictable revenue), case studies/testimonials, referrals to other advisors, and long-term commitment.

What’s the biggest mistake advisors make when buying technology?

The #1 mistake is buying tools before defining workflows. This leads to:

- Mismatched solutions that don’t fit your process

- Expensive customization to make tools work

- Abandoned implementations (bought but never used)

- Team resistance due to poor fit

The right approach:

- Map your ideal client experience and workflow FIRST

- Identify pain points and inefficiencies

- Define requirements based on your actual needs

- THEN evaluate tools that match your workflow

Other common mistakes:

- Ignoring integration requirements

- Underestimating training time and costs

- Choosing cheapest option over best fit

- Failing to negotiate pricing

- Implementing too many tools simultaneously

Ready to Calculate Your 2026 Technology ROI?

The advisors who thrive in 2026 will be those who view technology as a strategic growth investment rather than an operational cost. With the right technology stack, you can:

- Reclaim 800+ hours annually currently spent on administrative tasks

- Increase capacity to serve 20-30% more clients without adding headcount

- Improve client satisfaction by delivering faster, more personalized service

- Reduce operational risk through automated compliance and documentation

- Scale efficiently as your firm grows from $100M to $500M+ AUM

Industry data is clear: firms spending 4-5% of revenue on technology see 16.6% AUM growth compared to 12.1% for manual workflows. The question isn’t whether to invest—it’s how to invest strategically.

See Investipal’s Integrated Workflow in Action

Investipal consolidates proposal generation, statement scanning, risk assessment, portfolio optimization, and compliance documentation into a single platform—helping advisors generate compliant proposals in under 10 minutes in typical workflows.

Book a 15-minute demo to see:

- How AI-powered statement scanning extracts portfolio data in seconds

- Live proposal generation from client data to compliant documents

- Automated IPS and Reg BI documentation

- ROI calculation specific to your firm size

Disclaimer: Technology outputs require advisor review and are not investment advice. ROI calculations are illustrative examples based on industry benchmarks and typical use cases. Actual results may vary depending on firm size, workflows, and implementation quality. Past performance and case studies do not guarantee future results.

.png)