Manage US-Canada Portfolios in One Platform. No More Spreadsheets or Currency Headaches.

Investipal's AI handles multi-currency portfolios, dual-country statement aggregation, and cross-border compliance documentation—so you can serve expats, snowbirds, and dual citizens without the complexity. Most cross-border proposals are completed in under 15 minutes.

Schedule a Demo

Trusted by advisory firms across North America

Built for the Complexity of Cross-Border Wealth

Serving clients with assets in both the US and Canada shouldn't require two separate platforms, manual currency conversions, and hours of reconciliation. Investipal unifies your entire cross-border workflow into one intelligent platform.

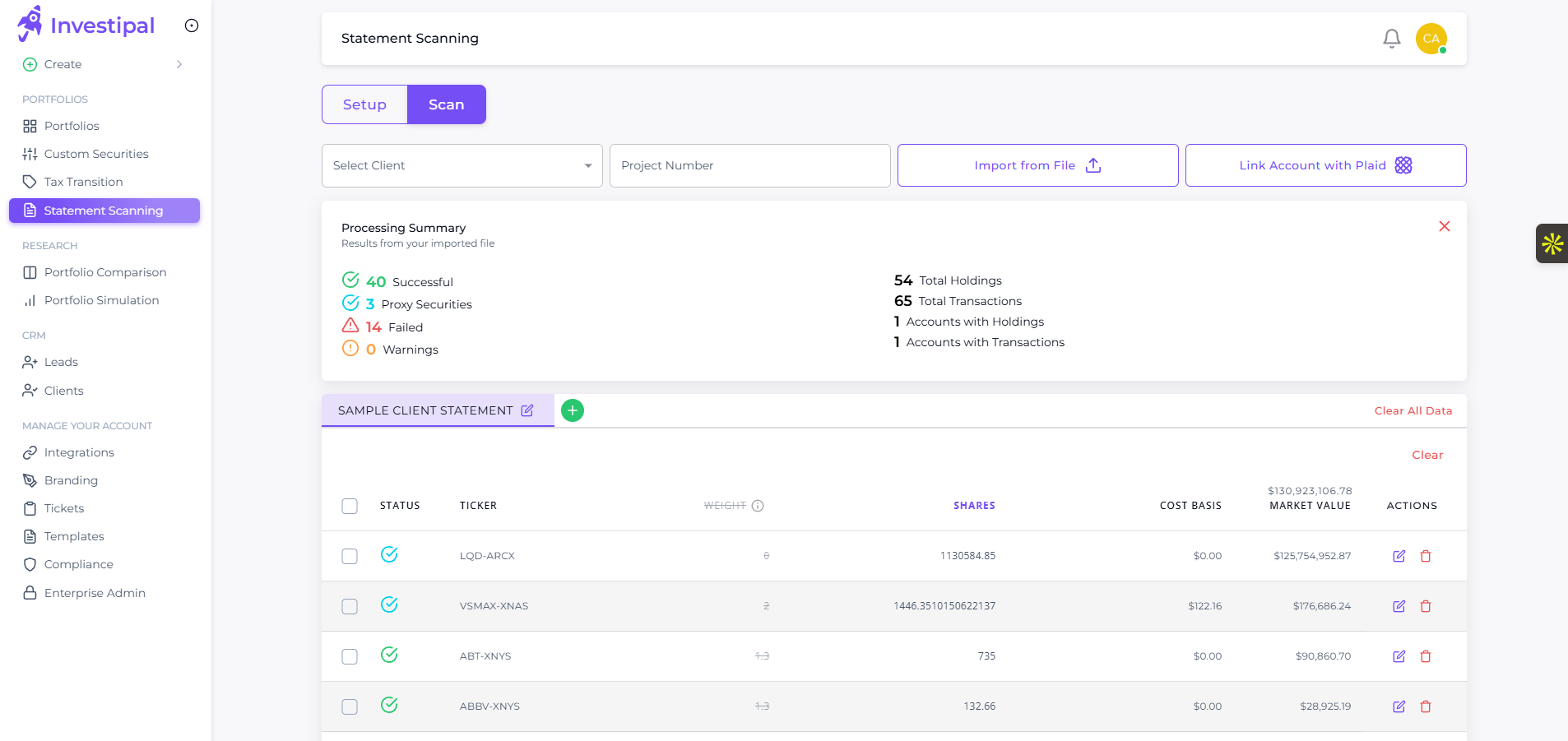

Aggregate US and Canadian Accounts in One Dashboard

- AI scans both US and Canadian statements – Upload PDFs from any North American brokerage. Our AI extracts holdings, allocations, and cost basis in seconds—whether it's in USD or CAD

- Multi-currency portfolio tracking – View consolidated portfolios with automatic CAD/USD conversion. Track currency exposure and see true asset allocation across both countries

- Unified data management – Manage all client holdings in one platform regardless of where accounts are custodied. No more switching between US and Canadian systems to see the full picture

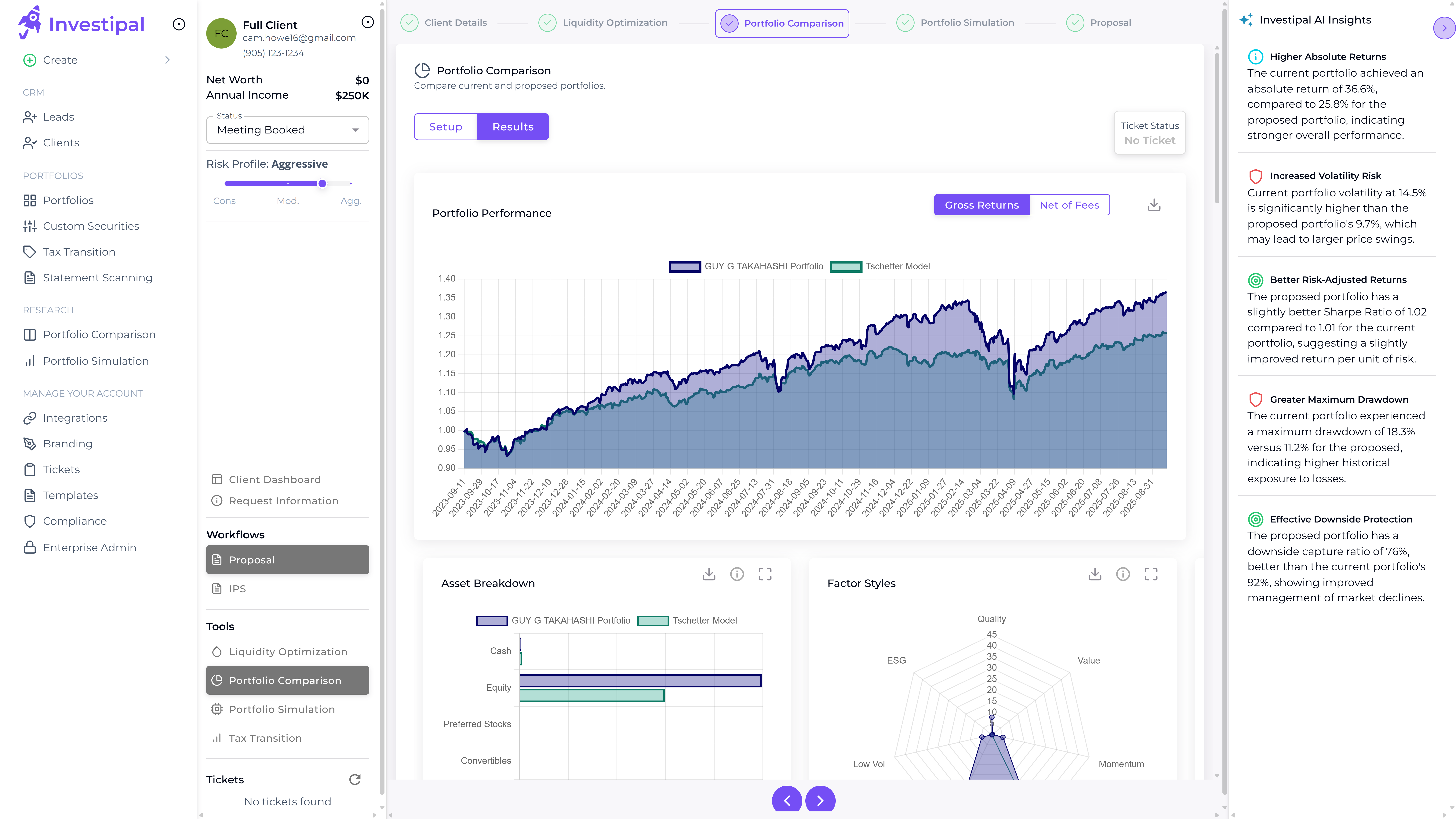

Build Cross-Border Portfolios Without the Complexity

- Unified multi-asset portfolio construction – Build portfolios with US equities, Canadian equities, ETFs from both countries, alternatives, and annuities. All in one optimization engine

- Account-type aware modeling – Properly handle RRSPs, TFSAs, RESPs, 401(k)s, IRAs, and taxable accounts. Understand which securities work in which account types to avoid PFIC issues

- Currency exposure tracking – Track CAD/USD exposure across the portfolio. See true asset allocation and performance across both currencies

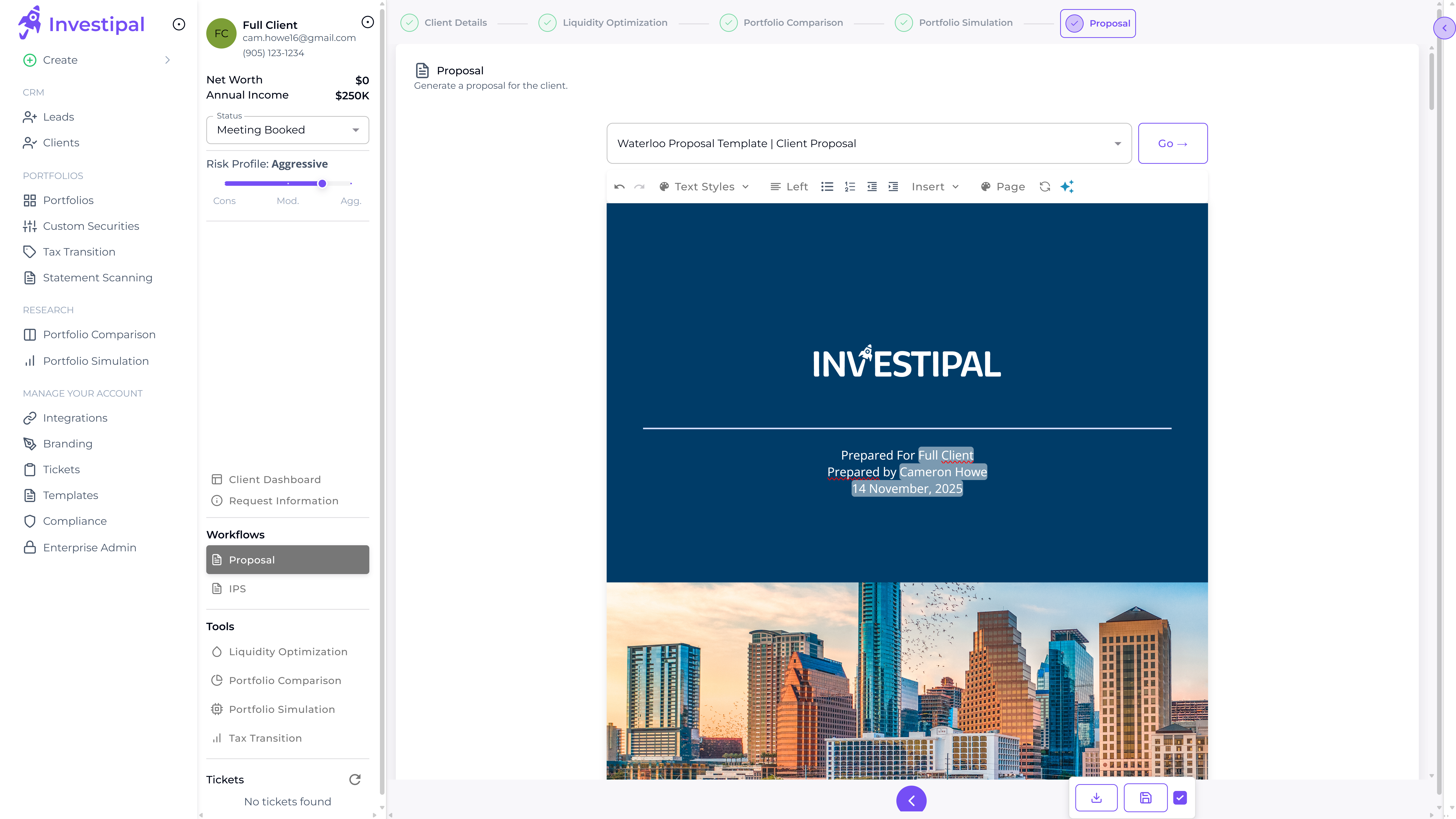

Generate Cross-Border Compliant Proposals and Documentation

- Cross-border aware proposals – Generate professional proposals that address US-Canada tax treaty implications, currency risk, and account-type considerations. AI writes compelling narratives in minutes

- IPS generation – Create Investment Policy Statements from portfolio data. Customize to document cross-border strategy and tax planning considerations specific to your clients

- Reg BI documentation – Automated Regulation Best Interest documentation for US clients. Document suitability and compliance requirements across both jurisdictions

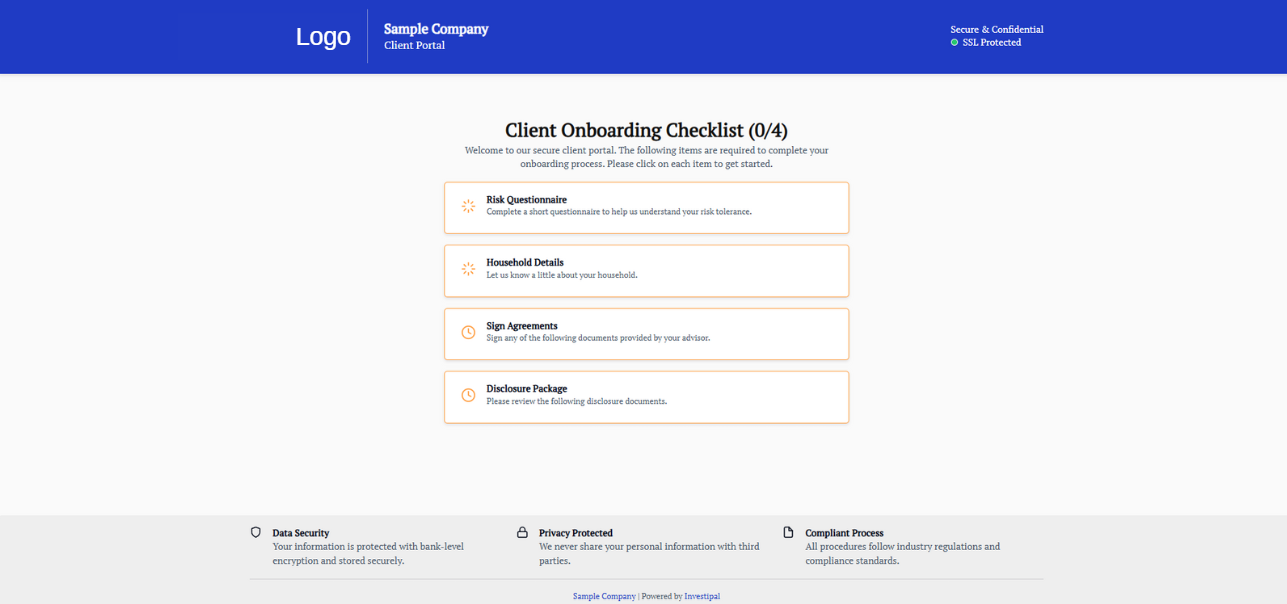

Onboard Cross-Border Clients in Days, Not Weeks

- One portal for complete onboarding – Configure your workflow once: risk assessment, statement upload (US and Canadian), AML verification, tax residency documentation, and advisory agreement signing

- Built-in e-signature and ID verification – Clients sign documents right in the portal. Scan driver's licenses (US or Canadian) and cross-check with OFAC automatically. No DocuSign, no extra logins

- Tax status and residency documentation – Collect tax residency information and citizenship status during onboarding. Store client tax status to inform portfolio construction and account-type decisions

Spend more time advising and less time on admin

Free up your time to spend on higher-value activities.

Explore Our Key Features

Powerful tools designed specifically for cross-border wealth management

Statement Scanner

Extract and analyze client portfolio data from any statement format instantly

Portfolio Optimization

AI-powered asset allocation across public and alternative investments

Client Acquisition

Automate proposals, risk assessment, and prospect conversion

Risk Management

Real-time risk monitoring and automated portfolio rebalancing

Reg BI Compliance

Automated compliance documentation and disclosure generation

IPS Generator

Generate personalized Investment Policy Statements with AI

Frequently Asked Questions

Have questions? We have answers.

Investipal automatically tracks holdings in both USD and CAD with real-time currency conversion. You can view consolidated portfolios in either currency and track currency exposure across accounts. All portfolio analytics, risk metrics, and performance reporting work seamlessly across both currencies.

Yes. Our AI-powered statement scanner handles all major Canadian brokerages including TD Canada Trust, RBC Direct Investing, BMO InvestorLine, Scotiabank iTRADE, Questrade, Wealthsimple, and Interactive Brokers Canada—plus all major US brokerages. Upload any PDF statement and holdings are extracted in 30 seconds, regardless of format or currency.

Investipal recognizes all Canadian registered accounts (RRSPs, TFSAs, RESPs, RRIFs) and US retirement accounts (401(k)s, IRAs, Roth IRAs). The platform tracks which securities are held in which account types, helping you avoid PFIC issues with Canadian mutual funds in US taxable accounts. Portfolio optimization considers account-type tax implications.

Yes. Investipal's AI can generate proposal narratives that address US-Canada tax treaty considerations, currency risk, account-type suitability, and estate planning implications. You can customize AI prompts to include specific cross-border talking points. All proposals can be branded with your firm's logo and colors.

Most wealth management platforms are built for either the US or Canada—not both. Investipal is one of the only platforms that natively handles multi-currency portfolios, aggregates statements from both countries, and understands both US and Canadian account types. You get one unified platform instead of juggling separate US and Canadian tools.

Enterprise-Grade Security

Your data is protected with bank-level security

Compliance & Privacy

Ensure adherence to SEC/FINRA standards with built-in compliance and privacy features. No user data is used in training.

Security

Investipal is SOC2 Type II compliant and all data is fully protected with advanced encryption and secure protocols.

Scalability

Grow through technology, not headcount.

"We're deeply committed to integrating cutting-edge technology to transform the financial planning and investment management landscape. Investipal's innovative approach aligns perfectly with our vision, particularly in utilizing OCR technology to streamline processes to elevate the client and advisor experience."

See Investipal in Action

Curious how Investipal can help accelerate your firm's growth? Chat with one of our solution experts.

Schedule a Demo