Choosing the right wealth management software can transform your RIA’s efficiency, client experience, and growth trajectory. But with dozens of platforms claiming to be “all-in-one” solutions, how do you cut through the noise and find the right fit?

This guide compares the top 5 wealth management platforms for RIAs in 2025: Investipal, Orion Advisor Tech, Black Diamond, Envestnet Tamarac, and Addepar. We’ll break down features, use cases, strengths, and weaknesses to help you make an informed decision.

Note: This guide is published by Investipal. We’ve aimed to provide accurate information about all platforms, but encourage readers to evaluate each solution based on their specific needs.

Quick Comparison: At a Glance

| Platform | Best For | Key Strength | Unique Feature |

|---|---|---|---|

| Investipal | RIAs of all sizes | AI automation + speed | Liquidity optimization, AI portfolio commentary |

| Orion | Mid-to-large RIAs | Comprehensive integrations | Largest CRM market share |

| Black Diamond | Multi-entity firms | Data aggregation | Alternative asset servicing |

| Envestnet Tamarac | Enterprise RIAs | End-to-end platform | Unified managed accounts (UMA) |

| Addepar | Family offices & high-net-worth | Complex portfolio reporting | Multi-currency, held-away assets |

1. Investipal: AI-Powered All-in-One for Growth-Focused RIAs

Overview

Investipal is an all-in-one wealth management platform designed for RIAs of all sizes—from solo practitioners to large multi-advisor firms. It automates the entire advisor workflow—from client onboarding to portfolio management, compliance, and reporting—using AI-powered tools.

Who It’s For

- Solo advisors looking to scale without hiring staff

- Growing RIAs who want simplicity + power

- Large firms seeking AI-driven efficiency across 100+ advisors

- Advisors working with alternatives (annuities, structured products, private equity)

- Retirement income planners who need liquidity optimization

- Advisors who value speed (proposals in 10 minutes, IPS in 60 seconds)

Key Features

AI-Powered Automation

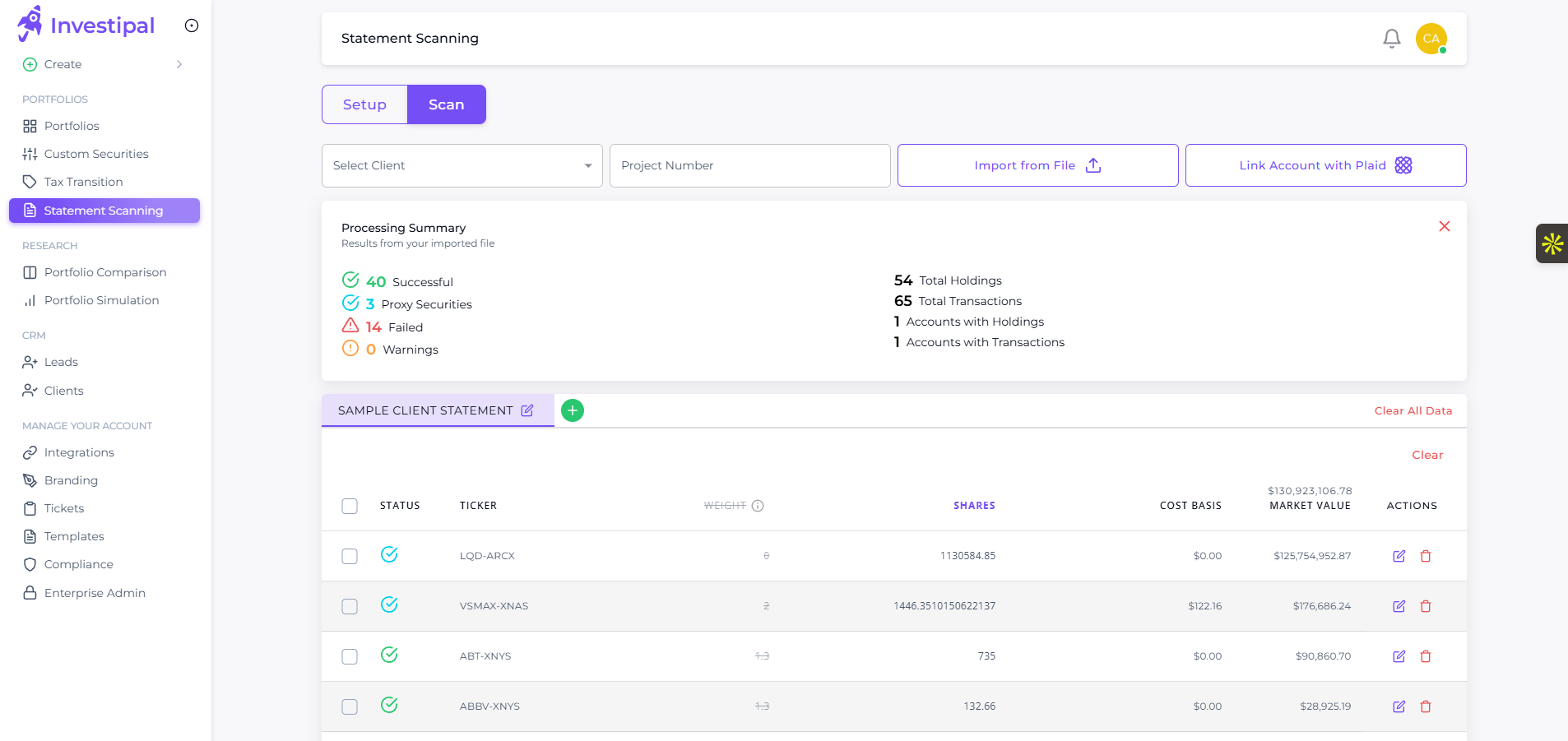

AI Statement Scanning (OCR + ML)

- Upload any brokerage statement (Schwab, Fidelity, TD Ameritrade, etc.)

- AI extracts holdings, cost basis, dividends in 2 minutes

- Time savings: 50-page statement → data table in 2 minutes vs. 30-60 minutes manual

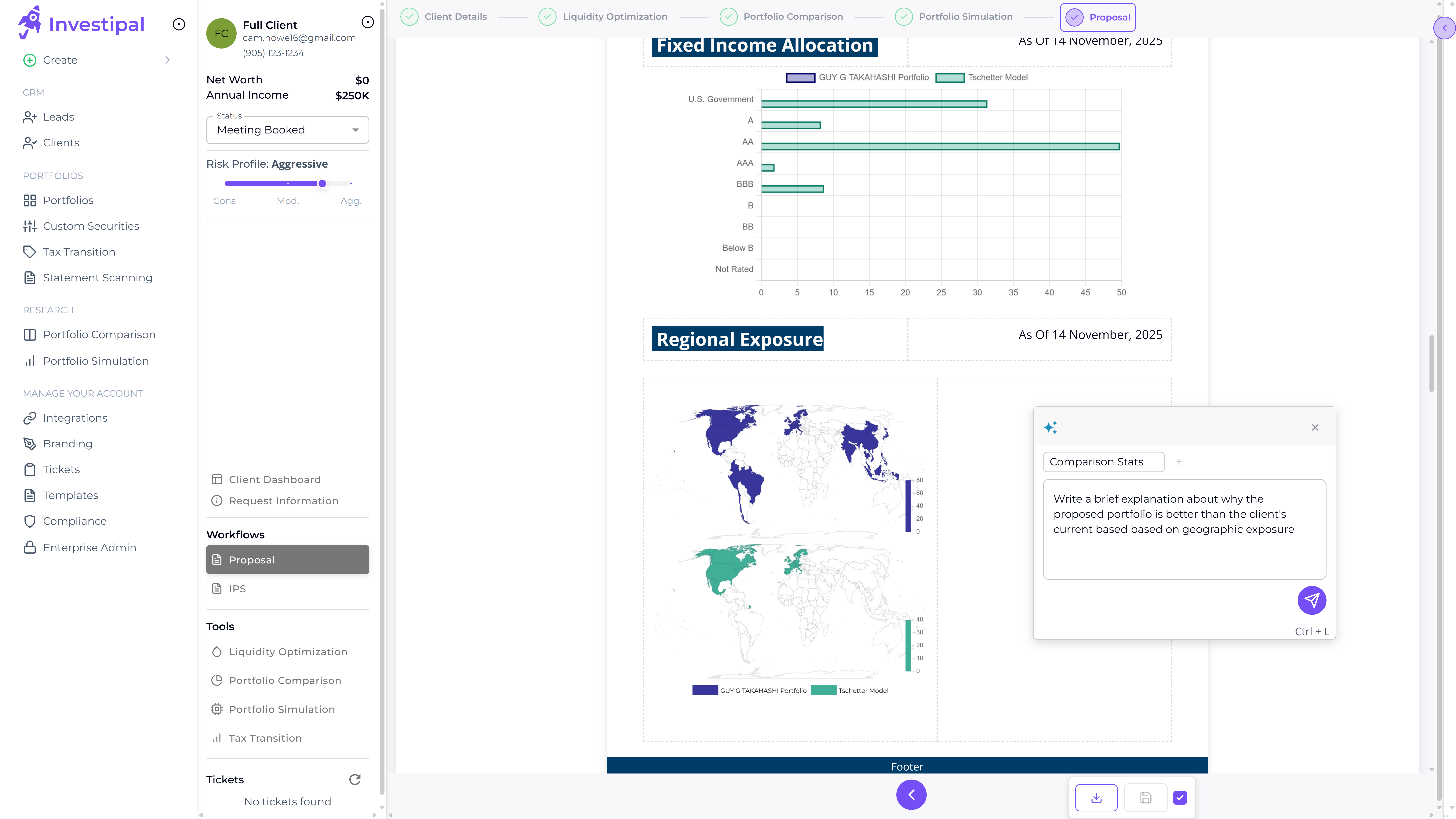

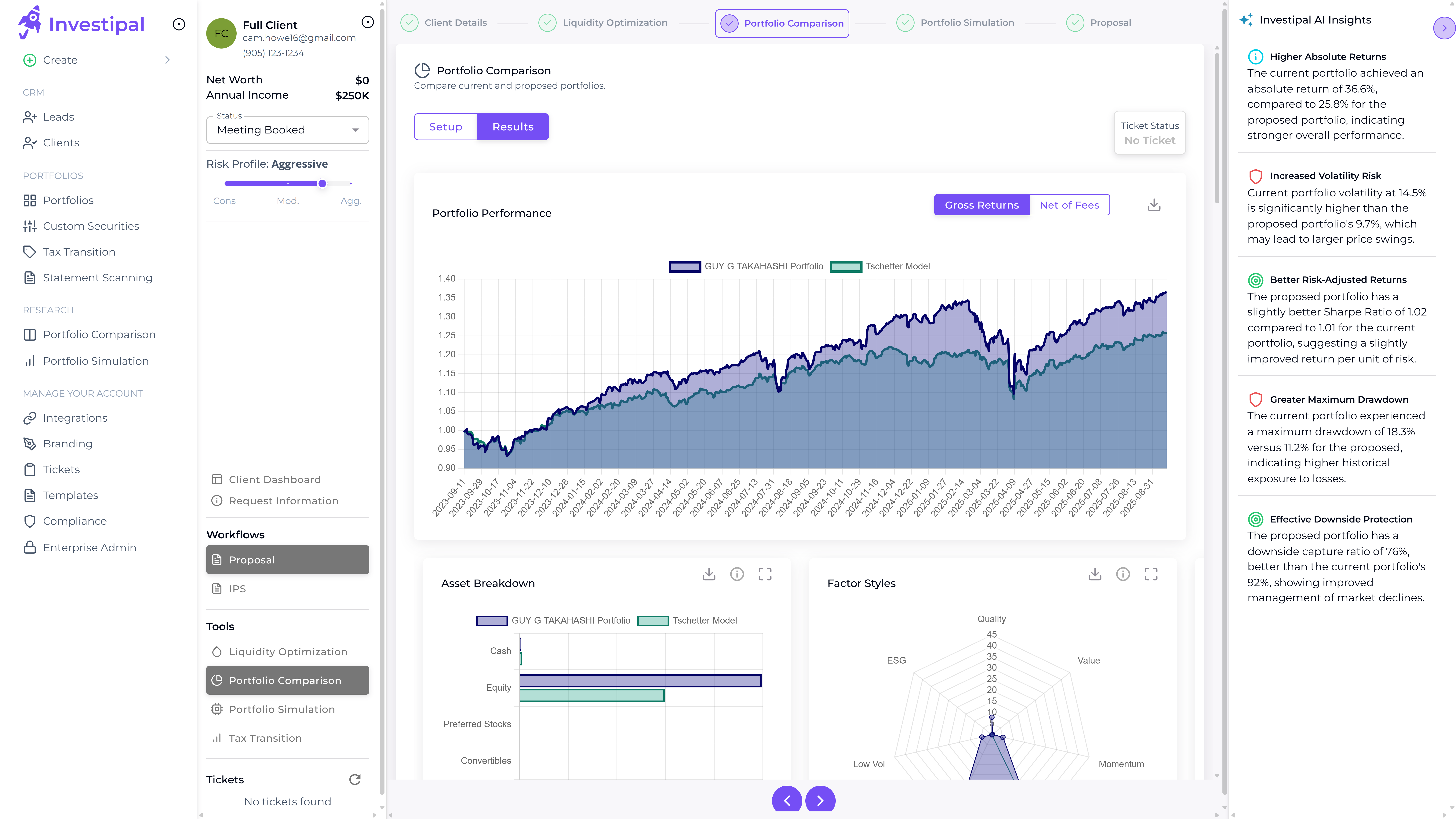

AI-Generated Portfolio Commentary

- AI analyzes portfolio holdings + market conditions → generates personalized commentary

- Two use cases:

- Client reporting: Quarterly updates for existing clients

- Proposal personalization: Explain why proposed portfolio fits prospect

- Example output: “Your portfolio’s 25% tech allocation performed well this quarter due to AI momentum, driving a +12% return. However, your bond holdings faced headwinds from rate volatility…”

- Time savings: 30 minutes per client → 2 minutes automated

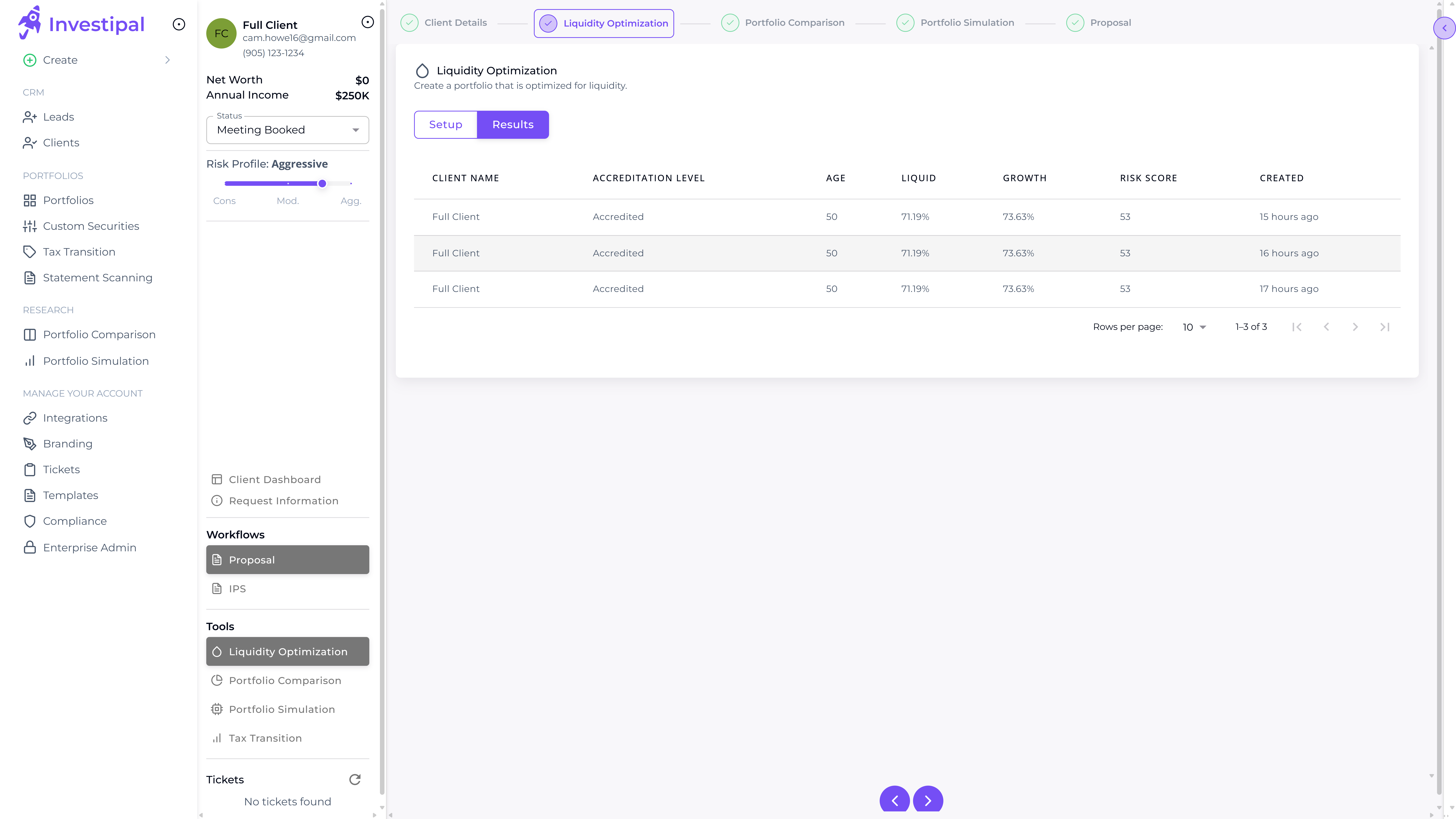

Liquidity Optimization

- How it works: Input client spending needs by year → system analyzes portfolio liquidity profile

- Output:

- Liquidity quadrant (income vs. growth allocation)

- Daily liquid surplus vs. requirements

- Contingent reserves (emergency fund analysis)

- Illiquid allocation limits

- Use cases:

- Retirement income planning (ensure adequate liquid reserves for 10-year spending)

- High-net-worth liquidity management

- Annuity/structured product allocation planning

- Time savings: 30 minutes manual analysis → 2 minutes automated

Portfolio Management & Analysis

Comparative Portfolio Analysis

- Compare current portfolio vs. multiple proposed models side-by-side

- Test 5-10 portfolio strategies simultaneously

- Analysis includes: Performance, asset breakdown, factor exposure (quality, value, growth, momentum), sector/geographic exposure, correlation, risk metrics (Sharpe, VaR, CVaR, max drawdown)

- Time savings: 5 minutes for comprehensive multi-model analysis vs. 2+ hours manual

Monte Carlo Simulation & Scenario Analysis

- Probabilistic projections of portfolio outcomes

- Test portfolio performance under different market conditions

- Example: “90% probability of $2M in 20 years with $100K/year spending”

Portfolio Design

- Advisors manually select securities and set target allocations

- Supported asset classes: Equities, bonds, alternatives (private equity, real estate, hedge funds), annuities, custom securities

Multi-Asset Portfolio Support

Custom Securities Builder

- Model any non-standard security: annuities (fixed, variable, indexed), structured products, private placements

- Build portfolios with 70% stocks/bonds + 20% private real estate + 10% structured notes

Alternatives Database

- Pre-built models for private equity, real estate, hedge funds, commodities

- Add alternatives to portfolios alongside traditional assets

Portfolio Optimization Methods (4 Options)

- Equal Weight: Equal allocation to all holdings

- Minimum Volatility: Optimize for lowest portfolio volatility

- Maximum Sharpe: Optimize for highest risk-adjusted return

- Factor-Based: Target specific factor exposures (value, growth, quality)

Note: Investipal is a portfolio design and analysis platform—not a trading or execution system. You design portfolios in Investipal, then execute through your custodian.

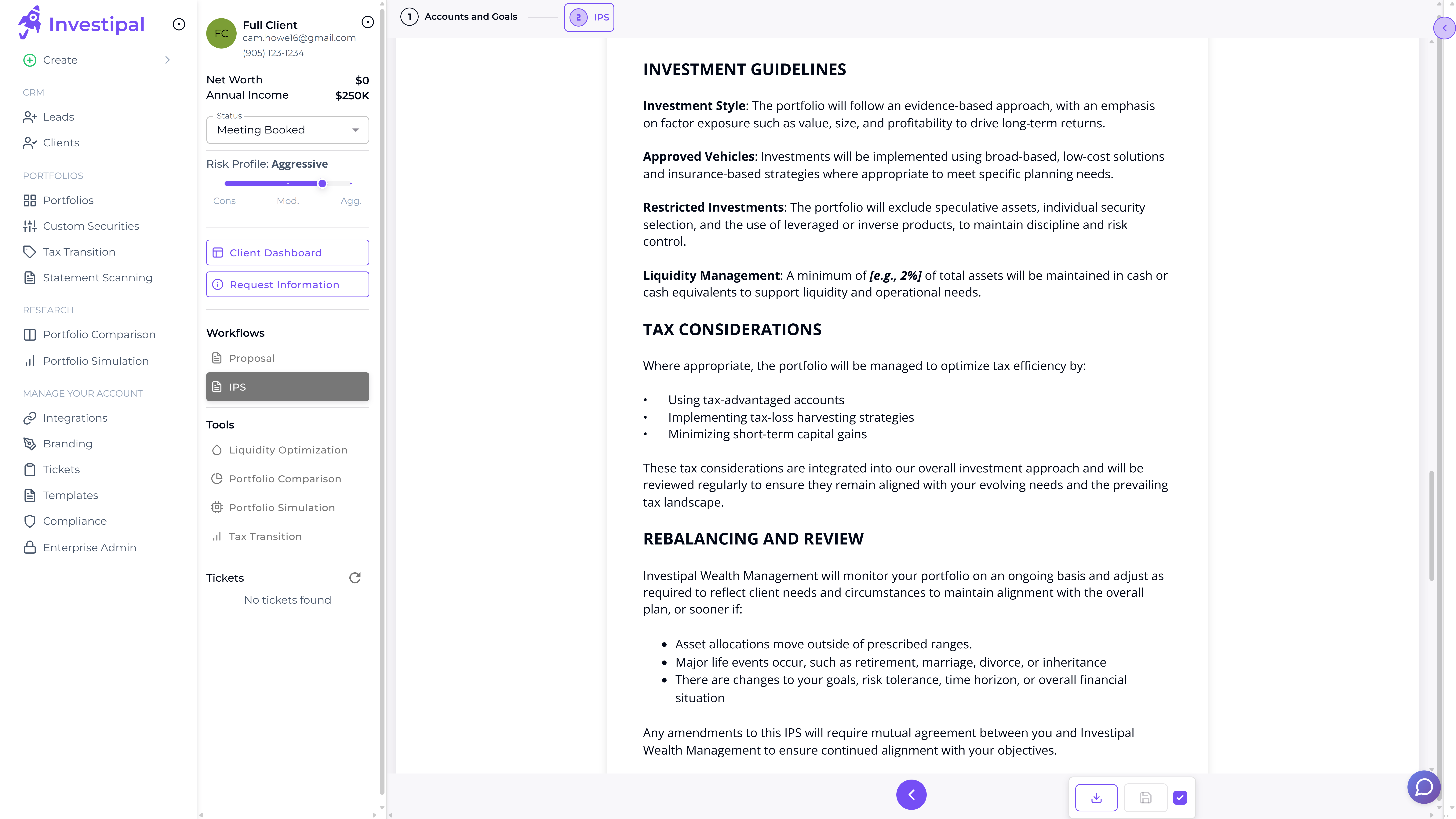

Compliance & Documentation

60-Second IPS Generation

- Risk questionnaire → IPS in 60 seconds

- Fully compliant (SEC, FINRA, state regulations)

- Customizable (firm-specific policies, disclosures)

- Time savings: 4-6 hours manual → 60 seconds automated

Reg BI Creation

- Auto-generate Regulation Best Interest disclosures

- Includes conflict of interest disclosures, material limitations, alternatives considered

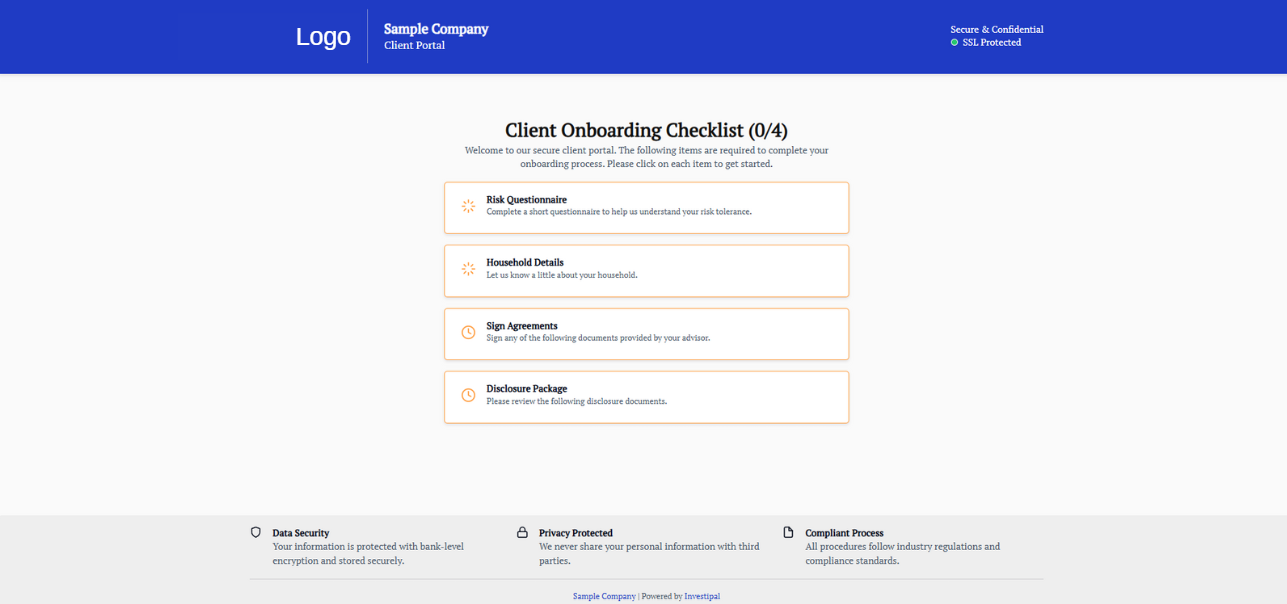

Client Onboarding & Proposals

Client Onboarding Portal

- Risk assessment, statement upload (or Plaid connection), personal information forms

- AML checks, e-signature for advisory agreements

- Schwab Integration: Directly open Schwab accounts from within Investipal

- Time savings: 3-5 days → same day onboarding

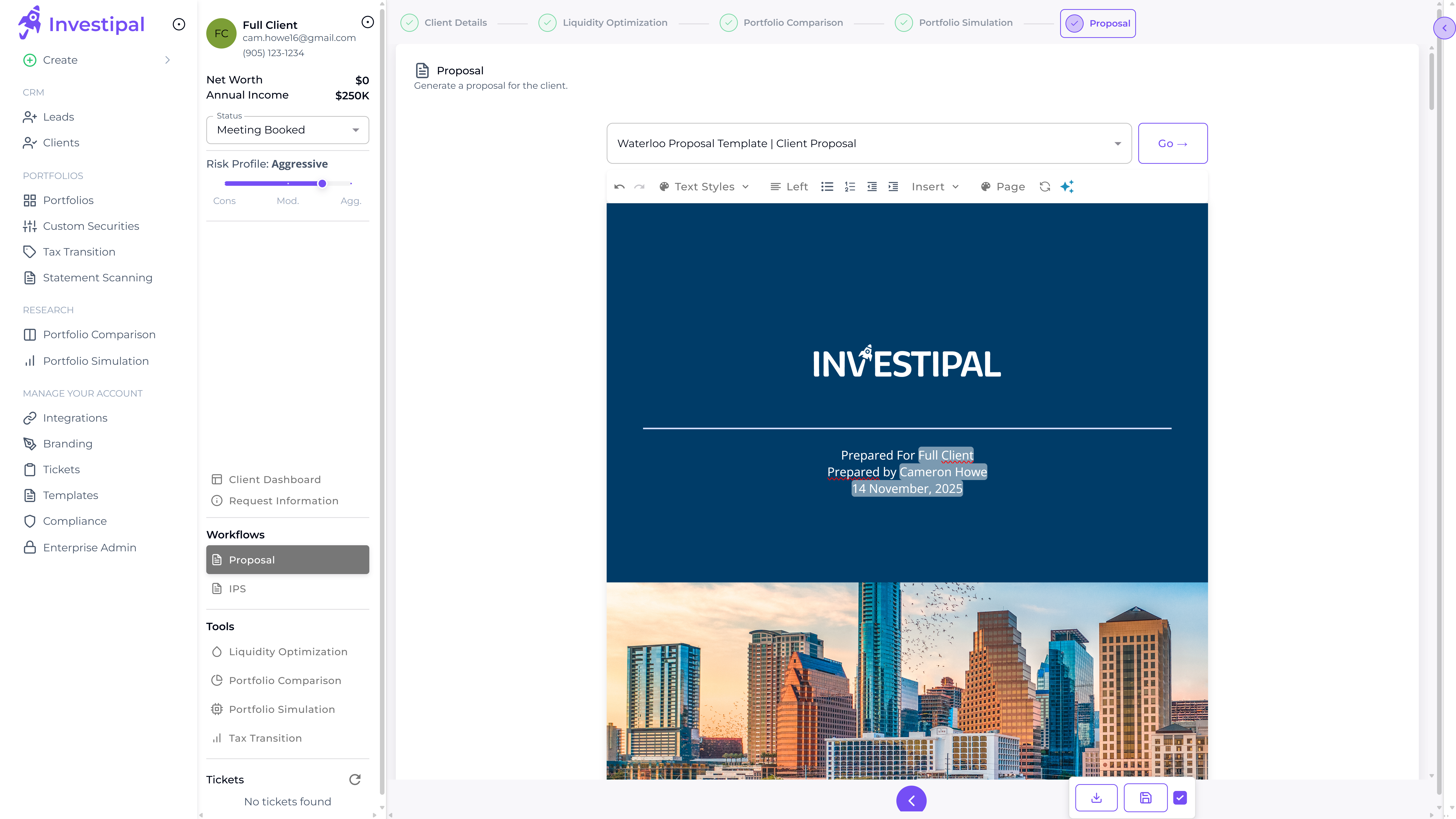

Proposal Generation

- Generate branded proposals with AI commentary in 10 minutes

- Comparative analysis (current vs. proposed), performance projections, IPS attached

- Time savings: 2-4 hours → 10 minutes

Integrations

- CRM: Salesforce, Wealthbox, Redtail (not a built-in CRM)

- Custodian: Schwab (includes account opening), more coming soon

- Account Aggregation: Plaid (connects to all major banks/brokerages)

Investipal Pros & Cons

Pros:

- Fastest proposals: 10 minutes from scan to proposal

- Unique features: Liquidity optimization, AI commentary, AI statement scanning

- All-in-one: No integration headaches

- Multi-asset support: Alternatives, annuities, custom securities

- Ease of use: Simple UI, minimal training required

- Speed: IPS in 60 seconds, onboarding in 1 day

Cons:

- Not a CRM: Integrates with Salesforce, Wealthbox, Redtail—but if you need a built-in CRM, you’ll need a separate tool

- Single custodian: Currently only Schwab integration (Fidelity, Pershing coming soon)

- Newer platform: Less established than Orion/Black Diamond (founded 2020 vs. 1999)

- Limited reporting: Performance reporting is functional but less customizable than Black Diamond

Investipal Use Cases

Use Case 1: Retirement Income Planning

- Client: 65-year-old retiree, $2M portfolio, needs $80K/year spending

- Workflow:

- Scan client’s current brokerage statement (2 min)

- Run liquidity optimization with $80K/year for 30 years (2 min)

- Review liquidity quadrant → identify need for more liquid reserves

- Design portfolio: 40% income (bonds, dividends) + 60% growth (stocks)

- Run comparative analysis (current vs. proposed)

- Generate proposal with AI commentary explaining liquidity strategy (5 min)

- Client accepts → onboard via digital portal (same day)

- Total time: 10-15 minutes vs. 4-6 hours manual

Use Case 2: Alternative Investment Allocation

- Client: High-net-worth, $5M portfolio, wants 20% in private real estate

- Workflow:

- Import current portfolio via Plaid (1 min)

- Add private real estate from alternatives database (2 min)

- Build portfolio: 60% stocks/bonds + 20% private real estate + 20% custom annuity

- Run Monte Carlo simulation (1 min)

- Generate proposal (5 min)

- Total time: 10 minutes vs. 3+ hours manual (most platforms don’t support alts)

Use Case 3: Quarterly Client Reporting (50 clients)

- Workflow:

- Run portfolio analysis for all 50 clients (5 min)

- Generate AI commentary for each client (2 min per client = 100 min total)

- Export reports (5 min)

- Total time: ~2 hours vs. 25 hours manual (30 min per client)

When to Choose Investipal

Choose Investipal if:

- You need liquidity optimization (retirement planning)

- You want AI automation (commentary, scanning) to save 8-12 hours per client

- You work with alternatives (annuities, structured products, private equity)

- You need built-in compliance (IPS, Reg BI in 60 seconds)

- You want all-in-one (no integration headaches)

- You value speed (proposals in 10 minutes, onboarding in 1 day)

Skip Investipal if:

- You need a built-in CRM (use Salesforce/Wealthbox + Investipal instead)

- You need multi-custodian support (currently Schwab only)

2. Orion Advisor Tech: Comprehensive Integrations for Mid-to-Large RIAs

Overview

Orion is one of the largest all-in-one platforms for RIAs, offering portfolio accounting, CRM (Redtail), financial planning, trading, compliance, and risk intelligence. Orion holds the #1 market share for CRM and portfolio management tools among advisors.

Who It’s For

- Mid-to-large RIAs (10-100+ advisors)

- Advisors who need extensive integrations (100+ integrations available)

- Firms using Redtail CRM (owned by Orion)

- Advisors who value proven scalability (17 of the Top 20 Barron’s RIAs use Orion)

Key Features

Portfolio Accounting

- #1 portfolio accounting solution by market share

- Personalized reports for any client preference

- Get paid faster with automated billing

Redtail CRM

- Industry’s #1 CRM by market share

- Contact management, pipeline tracking, workflow automation

- Integration: Seamlessly integrates with Orion portfolio accounting

Trading & Rebalancing

- Tax-intelligent trading at scale

- 85% of Orion clients use Orion Trading

- Threshold-based rebalancing, tax-loss harvesting

Financial Planning

- Behavioral finance tools (powered by Orion’s acquisition of BehaviorGap)

- Connect client goals with investment strategies

- Integrates with portfolio data

Compliance

- Get your firm exam-ready

- Compliance tracking, supervisory reviews, policy management

Client Portal

- Create unforgettable client experiences

- Account aggregation, document vault, secure messaging

Risk Intelligence

- Understand risk and uncover opportunity

- Risk tolerance questionnaires, portfolio risk scoring

** Integrations**

- 100+ integrations (custodians, financial planning, CRM, document management, etc.)

- Open API: 100% of Orion data available via API

Orion Pros & Cons

Pros:

- Market leader: #1 market share for CRM and portfolio accounting

- Comprehensive integrations: 100+ integrations, open API

- Scalable: Used by 17 of Top 20 Barron’s RIAs

- Proven reliability: 95% client retention rate

- Built-in CRM: Redtail CRM included

- Strong trading: 85% of large clients use Orion Trading

Cons:

- Complexity: Steep learning curve for new users

- No AI automation: No AI statement scanning, commentary, or portfolio construction

- No liquidity optimization: Missing retirement income planning tools

- Limited alternatives support: Primarily stocks/bonds/ETFs

- Higher cost: Enterprise-level solution

When to Choose Orion

Choose Orion if:

- You’re a mid-to-large RIA (10-100+ advisors)

- You need a built-in CRM (Redtail)

- You value extensive integrations (100+ options)

- You need proven scalability (used by mega RIAs)

- You have dedicated operations staff (to manage complexity)

Skip Orion if:

- You’re a solo advisor or small RIA (too complex)

- You want AI automation (statement scanning, commentary)

- You need liquidity optimization for retirement planning

- You work heavily with alternatives (annuities, private equity)

3. SS&C Black Diamond: Data Aggregation for Multi-Entity Firms

Overview

Black Diamond is a comprehensive wealth management platform owned by SS&C Technologies, designed for RIAs, family offices, banks, and broker-dealers. It excels in data aggregation, alternative asset servicing, and handling complex multi-entity structures.

Who It’s For

- Multi-entity firms (RIAs with multiple legal entities)

- Family offices with complex structures

- Banks & trust companies

- Firms with alternative investments (private equity, hedge funds, real estate)

Key Features

** Data Aggregation & Accounting**

- Reconciled and reliable data from hundreds of sources

- 99%+ reconciliation rate before market open

- Handles complex entity structures

** Alternative Asset Servicing**

- Automated collection, processing, and data integration for alternatives

- Private equity, hedge funds, real estate, commodities

- Competitor advantage: Best-in-class alternative asset support

** Portfolio Management & Reporting**

- Flexible tools to illustrate strategies across clients

- Customizable dashboards, branded reports

- Detailed performance attribution

Trading & Rebalancing

- Monitor, rebalance, and execute trades

- Tax-intelligent trading, threshold-based rebalancing

** CRM**

- Enhance prospecting, pipeline management, onboarding

- Relationship nurturing tools

** Business Intelligence & Research**

- Actionable analytics from virtually any data point

- Advisor dashboards, firm-wide insights

** Trust & Retirement**

- Powerful accounting, reporting, payments for trust accounts

- Unique asset valuation solutions

Black Diamond Pros & Cons

Pros:

- Best alternative asset support: Private equity, hedge funds, real estate

- Multi-entity expertise: Handles complex structures (RIAs, family offices, trusts)

- Data reliability: 99%+ reconciliation before market open

- Comprehensive platform: CRM, portfolio management, trading, compliance, trust accounting

- SS&C backing: $15B+ invested in R&D since 2012

Cons:

- Complexity: Not designed for small firms

- No AI automation: No AI statement scanning or commentary

- No liquidity optimization: Missing retirement income planning tools

- Higher cost: Enterprise-level solution

- Steep learning curve: Requires dedicated operations staff

When to Choose Black Diamond

Choose Black Diamond if:

- You manage alternative investments (private equity, hedge funds, real estate)

- You’re a multi-entity firm (RIAs, family offices, trusts)

- You need best-in-class data aggregation

- You have complex client structures

- You have dedicated operations staff

Skip Black Diamond if:

- You’re a solo advisor or small RIA

- You don’t work with alternatives

- You want AI automation (statement scanning, commentary)

- You need simplicity and speed

4. Envestnet Tamarac: End-to-End Platform for Enterprise RIAs

Overview

Envestnet Tamarac is an end-to-end wealth management platform for RIAs, offering portfolio management, CRM, reporting, trading, client portal, billing, and unified managed accounts (UMA). It’s designed for mid-to-large RIAs who want a comprehensive solution.

Who It’s For

- Enterprise RIAs (20-500+ advisors)

- Firms using unified managed accounts (UMA)

- Advisors who want end-to-end integration

- Firms seeking outsourced investment management (OCIO)

Key Features

** Portfolio Management & Reporting**

- Flexible reporting, performance attribution, risk analysis

- Custodian-agnostic platform

** CRM**

- Client relationship management, pipeline tracking, workflow automation

Trading & Rebalancing

- Tax-intelligent trading, automated rebalancing

- Model management, trade order management

** Unified Managed Accounts (UMA)**

- Combine multiple investment strategies in a single account

- Tax-efficient overlay management

- Competitor advantage: Best-in-class UMA capabilities

Client Portal

- Interactive client portal with account aggregation

- Document vault, secure messaging, financial planning access

** Billing Solutions**

- Customize fee structures, streamline invoicing, track revenue

- Automated billing, fee schedules, invoice generation

** Proposal Tool**

- Generate investment proposals for prospects

- Customizable templates, performance projections

Envestnet Tamarac Pros & Cons

Pros:

- End-to-end platform: CRM, portfolio management, trading, billing, UMA

- Best-in-class UMA: Unified managed accounts with tax overlay

- Scalable: Designed for enterprise RIAs (20-500+ advisors)

- Custodian-agnostic: Works with multiple custodians

- Comprehensive: All tools in one platform

Cons:

- Complexity: Requires significant training and onboarding

- No AI automation: No AI statement scanning or commentary

- No liquidity optimization: Missing retirement income planning tools

- Higher cost: Enterprise-level solution

- Not for small firms: Overkill for solo advisors or small RIAs

When to Choose Envestnet Tamarac

Choose Envestnet Tamarac if:

- You’re an enterprise RIA (20-500+ advisors)

- You use unified managed accounts (UMA)

- You want an end-to-end platform (no integrations needed)

- You have dedicated operations and tech staff

- You’re custodian-agnostic

Skip Envestnet Tamarac if:

- You’re a solo advisor or small RIA

- You want AI automation (statement scanning, commentary)

- You need simplicity and speed

- You work heavily with alternatives (better options exist)

5. Addepar: Complex Portfolio Reporting for Family Offices

Overview

Addepar is an open architecture, multi-product tech and data platform designed for family offices, private banks, and institutions managing complex, high-net-worth portfolios. It excels in data aggregation, multi-currency support, and reporting on held-away and private assets.

Who It’s For

- Family offices (single-family and multi-family)

- Private banks with ultra-high-net-worth clients

- Institutions managing complex portfolios

- Advisors managing held-away assets (assets not at a custodian)

Key Features

** Comprehensive Data Aggregation**

- Aggregate all financial accounts (custodial, held-away, private assets)

- Multi-currency support

- Private equity, real estate, hedge funds, art, collectibles

- Competitor advantage: Best-in-class aggregation for held-away assets

** Portfolio Reporting**

- Instantly analyze and visualize portfolio data

- Customizable, branded reports in minutes

- Performance attribution, risk analysis, asset allocation

** Scenario Modeling & Forecasting**

- Model asset allocations (including illiquid assets)

- Test hypothetical performance across different scenarios

- Capital market assumptions, Monte Carlo simulation

Trading & Rebalancing

- Portfolio trading powered by aggregated Addepar data

- Rebalance on demand for select accounts or entire book of business

Client Portal

- Encrypted access to financial information

- Mobile and iPad apps for secure portfolio access

** Billing & Fee Management**

- Simplify fee calculation, production, and tracking

- Granular fee calculations, billing summary

Addepar Pros & Cons

Pros:

- Best aggregation: Held-away assets, private assets, multi-currency

- Complex portfolio support: Art, collectibles, private equity, real estate

- Scenario modeling: Test hypothetical allocations and outcomes

- Family office expertise: Purpose-built for ultra-high-net-worth

- Mobile access: Stunning mobile and iPad apps

- Security: Best-practice safeguards, role-based access

Cons:

- Highest cost: Most expensive platform on this list

- Overkill for simple portfolios: Designed for complexity

- No AI automation: No AI statement scanning or commentary

- No liquidity optimization: Missing retirement income planning tools

- Not for small RIAs: Designed for family offices and institutions

When to Choose Addepar

Choose Addepar if:

- You’re a family office or private bank

- You manage ultra-high-net-worth clients (UHNW)

- You need to aggregate held-away assets (real estate, private equity, art)

- You require multi-currency support

- You need complex scenario modeling

- Cost is not a constraint

Skip Addepar if:

- You’re a solo advisor or small RIA

- You manage primarily stocks/bonds portfolios (overkill)

- You want AI automation (statement scanning, commentary)

- You need simplicity and speed

- Budget is a concern

Feature Comparison Table

| Feature | Investipal | Orion | Black Diamond | Envestnet Tamarac | Addepar |

|---|---|---|---|---|---|

| Portfolio Management | Yes | Yes | Yes | Yes | Yes |

| Comparative Analysis | Yes | Yes | Yes | Yes | Yes |

| Trading & Rebalancing | Design Only | Yes | Yes | Yes | Yes |

| Risk Assessment | Yes | Yes | Yes | Yes | Yes |

| Monte Carlo Simulation | Yes | Yes | Yes | Yes | Yes |

| Financial Planning | Integrates | Yes | Yes | Yes | Yes |

| CRM | Integrates | Yes (Redtail) | Yes | Yes | Integrates |

| Client Portal | Coming Soon | Yes | Yes | Yes | Yes |

| Billing/Invoicing | No | Yes | Yes | Yes | Yes |

| Compliance Tools | Yes (IPS, Reg BI) | Yes | Yes | Yes | No |

| AI Statement Scanning | Yes | No | No | No | No |

| AI Portfolio Commentary | Yes | No | No | No | No |

| Liquidity Optimization | Yes | No | No | No | No |

| 60-Second IPS Generation | Yes | No | No | No | No |

| Multi-Asset Support | Full | Partial | Best | Partial | Best |

| Alternative Assets | Yes | Partial | Best | Partial | Best |

| Custodian Integration | Schwab | Many | Many | Many | Many |

| Account Aggregation | Yes (Plaid) | Yes | Yes | Yes | Best |

| Unified Managed Accounts | No | No | No | Yes | No |

| Held-Away Assets | No | Partial | Yes | Partial | Best |

| Multi-Currency | No | No | Partial | Partial | Yes |

| Mobile App | No | No | No | Yes | Yes |

Use Case Comparison: Which Platform Fits Your Firm?

Scenario 1: Solo Advisor, $50M AUM, Retirement Income Focus

Best Fit: Investipal

Why:

- Liquidity optimization solves retirement income planning (unique feature)

- AI commentary saves 30 min per client (25+ hours/month with 50 clients)

- All-in-one platform (no integration headaches)

- Fastest proposals (10 minutes) and IPS generation (60 seconds)

Runner-up: Orion (if you need built-in CRM)

Scenario 2: Mid-Sized RIA, 15 Advisors, $500M AUM, Growth Focus

Best Fit: Orion

Why:

- Proven scalability (used by 17 of Top 20 Barron’s RIAs)

- Built-in Redtail CRM for team collaboration

- Comprehensive integrations (100+ options)

- Strong trading capabilities (85% of large clients use Orion Trading)

Runner-up: Envestnet Tamarac (if you need UMA)

Scenario 3: Family Office, $2B AUM, Complex Holdings (Private Equity, Real Estate, Art)

Best Fit: Addepar

Why:

- Best aggregation for held-away assets (private equity, real estate, art)

- Multi-currency support

- Scenario modeling for complex portfolios

- Purpose-built for family offices

Runner-up: Black Diamond (if you need trust accounting)

Scenario 4: Small RIA, 5 Advisors, $150M AUM, Alternative Investments (Annuities, Private Equity)

Best Fit: Investipal

Why:

- Full multi-asset support (alternatives database + custom securities builder)

- Build portfolios with 70% stocks/bonds + 20% private real estate + 10% annuities

- AI statement scanning (eliminates manual data entry)

- All-in-one platform (no integration headaches)

Runner-up: Black Diamond (if you need enterprise-level alternative asset servicing)

Scenario 5: Enterprise RIA, 100+ Advisors, $5B AUM, Unified Managed Accounts

Best Fit: Envestnet Tamarac

Why:

- Best-in-class UMA capabilities (unified managed accounts with tax overlay)

- End-to-end platform (CRM, portfolio management, trading, billing)

- Scalable for 100+ advisors

- Custodian-agnostic

Runner-up: Orion (if UMA is not critical)

Time Savings Comparison

Here’s how much time each platform can save you per client engagement:

| Task | Investipal | Orion | Black Diamond | Envestnet | Addepar |

|---|---|---|---|---|---|

| Scan 50-page statement | 2 min | Manual (30-60 min) | Manual (30-60 min) | Manual (30-60 min) | Manual (30-60 min) |

| Generate IPS | 60 seconds | Manual (4-6 hours) | Manual (4-6 hours) | Manual (4-6 hours) | N/A |

| Generate proposal | 10 min | 1-2 hours | 1-2 hours | 1-2 hours | 1-2 hours |

| Write portfolio commentary | 2 min | Manual (30 min) | Manual (30 min) | Manual (30 min) | Manual (30 min) |

| Liquidity analysis | 2 min | Manual (30 min) | Manual (30 min) | Manual (30 min) | Manual (30 min) |

| Client onboarding | Same day | 3-5 days | 3-5 days | 3-5 days | 3-5 days |

| Comparative analysis | 5 min | 30-60 min | 30-60 min | 30-60 min | 30-60 min |

| TOTAL TIME SAVED PER CLIENT | 8-12 hours | Baseline | Baseline | Baseline | Baseline |

Annual time savings (50 clients/year with Investipal): 400-600 hours

Workflow Efficiency: How Each Platform Handles a New Client

Investipal Workflow (10-15 minutes)

1. Scan brokerage statement (2 min)

↓

2. Run portfolio analysis + liquidity optimization (3 min)

↓

3. Design proposed portfolio (5 min)

↓

4. Generate proposal with AI commentary (5 min)

↓

5. Generate IPS (60 seconds)

↓

6. Send proposal

↓

[Client accepts]

↓

7. Digital onboarding (same day)Total time: 10-15 minutes

Orion/Black Diamond/Envestnet/Addepar Workflow (4-6 hours)

1. Manually enter statement data OR request custodian feed (30-60 min)

↓

2. Run portfolio analysis (30 min)

↓

3. Design proposed portfolio (30-60 min)

↓

4. Write proposal commentary (30 min)

↓

5. Generate proposal (30 min)

↓

6. Manually create IPS (4-6 hours)

↓

7. Send proposal

↓

[Client accepts]

↓

8. Manual onboarding (3-5 days)Total time: 4-6 hours (not including IPS)

Frequently Asked Questions (FAQ)

Q: Which platform is best for solo advisors?

A: Investipal. It works well for advisors of all sizes, but solo advisors particularly benefit from its AI automation that eliminates the need for operations staff. You can run an entire advisory practice—client onboarding, portfolio analysis, proposals, compliance—by yourself in a fraction of the time.

Q: Which platform has the best CRM?

A: Orion (Redtail CRM). Orion owns Redtail, the #1 CRM by market share among financial advisors. If you need a built-in CRM, Orion is the clear winner.

However, Investipal integrates with Salesforce, Wealthbox, and Redtail, so you can use your existing CRM while gaining Investipal’s AI automation and liquidity optimization.

Q: Which platform is best for alternative investments?

A: Black Diamond and Addepar (tie). Both excel at alternative asset management:

- Black Diamond: Best for operational alternative asset servicing (automated data collection, processing, integration)

- Addepar: Best for reporting on held-away alternatives (private equity, real estate, art, collectibles)

Investipal also supports alternatives (custom securities builder, alternatives database) and is a better fit if you’re a small firm working with alternatives.

Q: Which platform saves the most time?

A: Investipal. With AI statement scanning (2 min vs. 30-60 min), 60-second IPS generation (vs. 4-6 hours), and AI portfolio commentary (2 min vs. 30 min), Investipal saves 8-12 hours per client.

Annual time savings (50 clients/year): 400-600 hours

Q: Which platform is best for retirement income planning?

A: Investipal. It’s the only platform with liquidity optimization—a feature that analyzes client spending needs and ensures adequate liquid reserves for retirement. This is critical for advisors who specialize in retirement income planning.

Q: Which platform is easiest to use?

A: Investipal. Designed for simplicity with minimal training required. Most advisors are up and running in 1-2 days.

Orion, Black Diamond, Envestnet, and Addepar have steep learning curves and require dedicated operations staff.

Q: Which platform is best for enterprise RIAs?

A: Envestnet Tamarac or Orion.

- Envestnet Tamarac: Best for enterprise RIAs using unified managed accounts (UMA)

- Orion: Best for enterprise RIAs who need extensive integrations (100+ options)

Q: Do I need to choose one platform, or can I mix and match?

A: You can mix and match. Many advisors use:

- Investipal for portfolio management + proposals + compliance (AI automation, liquidity optimization)

- Salesforce/Wealthbox/Redtail for CRM (Investipal integrates)

- MoneyGuidePro/eMoney for financial planning (integrate with Investipal)

This “best-of-breed” approach lets you get the best features from each platform.

Q: How long does implementation take?

A: Implementation timelines vary by platform complexity:

- Investipal: Same day to 1 week (simplest setup)

- Orion: 2-4 weeks (depends on integrations)

- Black Diamond: 4-8 weeks (data migration, customization)

- Envestnet Tamarac: 4-12 weeks (enterprise implementation)

- Addepar: 8-16+ weeks (complex customization, data migration)

Decision Framework: How to Choose the Right Platform

Use this framework to evaluate which platform fits your firm:

Step 1: Identify Your Firm Size & Complexity

| Firm Size | AUM | Best Platforms |

|---|---|---|

| Solo advisor | $10M-$100M | Investipal, Orion |

| Growing RIA (1-50 advisors) | $50M-$2B | Investipal, Orion |

| Mid-sized RIA (10-50 advisors) | $250M-$2B | Orion, Envestnet Tamarac |

| Enterprise RIA (50-500 advisors) | $1B-$10B+ | Envestnet Tamarac, Orion |

| Family office | $100M-$5B+ | Addepar, Black Diamond |

Step 2: Identify Your Top 3 Priorities

| Priority | Best Platforms |

|---|---|

| Speed & efficiency (fast proposals, quick onboarding) | Investipal, Orion |

| AI automation (statement scanning, commentary) | Investipal |

| Liquidity optimization (retirement income planning) | Investipal |

| Alternative investments (private equity, structured products) | Addepar, Black Diamond, Investipal |

| Built-in CRM | Orion, Black Diamond, Envestnet Tamarac |

| Extensive integrations (100+ options) | Orion, Envestnet Tamarac |

| Unified managed accounts (UMA) | Envestnet Tamarac |

| Held-away assets (real estate, art, collectibles) | Addepar, Black Diamond |

| Multi-currency support | Addepar |

| Enterprise scalability (50+ advisors) | Orion, Envestnet Tamarac |

| Best-in-class reporting | Black Diamond, Addepar |

Step 3: Evaluate Trade-Offs

| Priority | Investipal | Orion | Black Diamond | Envestnet | Addepar |

|---|---|---|---|---|---|

| Speed to Value | Excellent | Good | Good | Fair | Fair |

| AI Features | Excellent | Limited | Limited | Limited | Limited |

| Ease of Use | Excellent | Good | Good | Good | Fair |

| Reporting | Good | Very Good | Excellent | Very Good | Excellent |

| Alternatives | Very Good | Good | Excellent | Good | Excellent |

| CRM | Integrates | Excellent | Very Good | Very Good | Integrates |

| Integrations | Good | Excellent | Very Good | Excellent | Good |

| Scalability | Very Good | Excellent | Very Good | Excellent | Very Good |

| Complexity | Low | High | High | High | Very High |

| Best For | Growth-Focused RIAs | Mid-Large RIAs | Family Offices | Enterprise | UHNW/Family Offices |

Step 4: Request Demos

Before making a final decision:

- Request demos from your top 2-3 choices

- Test with real client data (scan a statement, build a proposal)

- Ask about onboarding time (how long to get up and running?)

- Evaluate support quality (response times, training resources)

- Check references (talk to 2-3 current clients)

Final Recommendations

Choose Investipal if:

- You’re an RIA of any size looking for AI-powered efficiency

- You need AI automation (save 8-12 hours per client)

- You specialize in retirement income planning (liquidity optimization)

- You work with alternatives (annuities, private equity, structured products)

- You value speed (proposals in 10 minutes, IPS in 60 seconds)

- You want all-in-one (no integration headaches)

Choose Orion if:

- You’re a mid-to-large RIA (10-100+ advisors)

- You need a built-in CRM (Redtail)

- You value extensive integrations (100+ options)

- You need proven scalability (used by mega RIAs)

- You have dedicated operations staff (to manage complexity)

Choose Black Diamond if:

- You’re a multi-entity firm (family offices, trusts, RIAs with complex structures)

- You manage alternative investments (private equity, hedge funds, real estate)

- You need best-in-class data aggregation

- You have complex client structures

- You have dedicated operations staff

Choose Envestnet Tamarac if:

- You’re an enterprise RIA (20-500+ advisors)

- You use unified managed accounts (UMA)

- You want an end-to-end platform (no integrations needed)

- You’re custodian-agnostic

- You have dedicated operations and tech staff

Choose Addepar if:

- You’re a family office or private bank

- You manage ultra-high-net-worth clients (UHNW)

- You need to aggregate held-away assets (real estate, private equity, art)

- You require multi-currency support

- You need complex scenario modeling

- Cost is not a constraint

Next Steps

Ready to find the right wealth management software for your RIA?

- Schedule a demo with Investipal to see AI automation, liquidity optimization, and proposal generation in action

- Explore Investipal’s features to learn more about AI statement scanning, portfolio management, and compliance automation

- Read our IPS guide to learn how Investipal generates IPS documents in 60 seconds

- Learn about liquidity optimization and how it solves retirement income planning

Related Resources

- How to Create an Investment Policy Statement: Complete Guide for RIAs

- What is a NIGO? Complete Guide to Reducing Not-In-Good-Order Documents

- Portfolio Construction Features

- About Investipal

Have questions about which platform is right for your firm? Contact our team and we’ll help you evaluate your options.