Portfolio risk software has become non-negotiable for financial advisors in 2025. With increasing regulatory scrutiny around Reg BI compliance, volatile markets, and clients demanding more transparency than ever, advisors need robust portfolio risk management tools that go beyond basic Monte Carlo simulations.

But here's the problem: most advisors are still using fragmented tools—one for risk tolerance questionnaires, another for portfolio analytics, a third for compliance documentation. This creates blind spots, wastes hours on manual work, and leaves you vulnerable to compliance gaps.

This guide breaks down the leading portfolio risk software solutions to help you find the right fit for your practice. Whether you're a solo RIA or managing a multi-advisor firm, you'll see how the top platforms compare on features, integrations, and real-world use cases.

What to Look for in Portfolio Risk Software

Before diving into the comparison, here are the critical capabilities that separate best-in-class portfolio risk tools from legacy solutions:

- Real-time portfolio monitoring: Automated drift detection and alerts when client allocations deviate from targets

- Comprehensive risk analytics: Beyond standard deviation—stress testing, drawdown analysis, concentration risk, and correlation mapping

- Held-away asset integration: Ability to analyze held-away brokerage accounts alongside custodied assets for a more complete household view

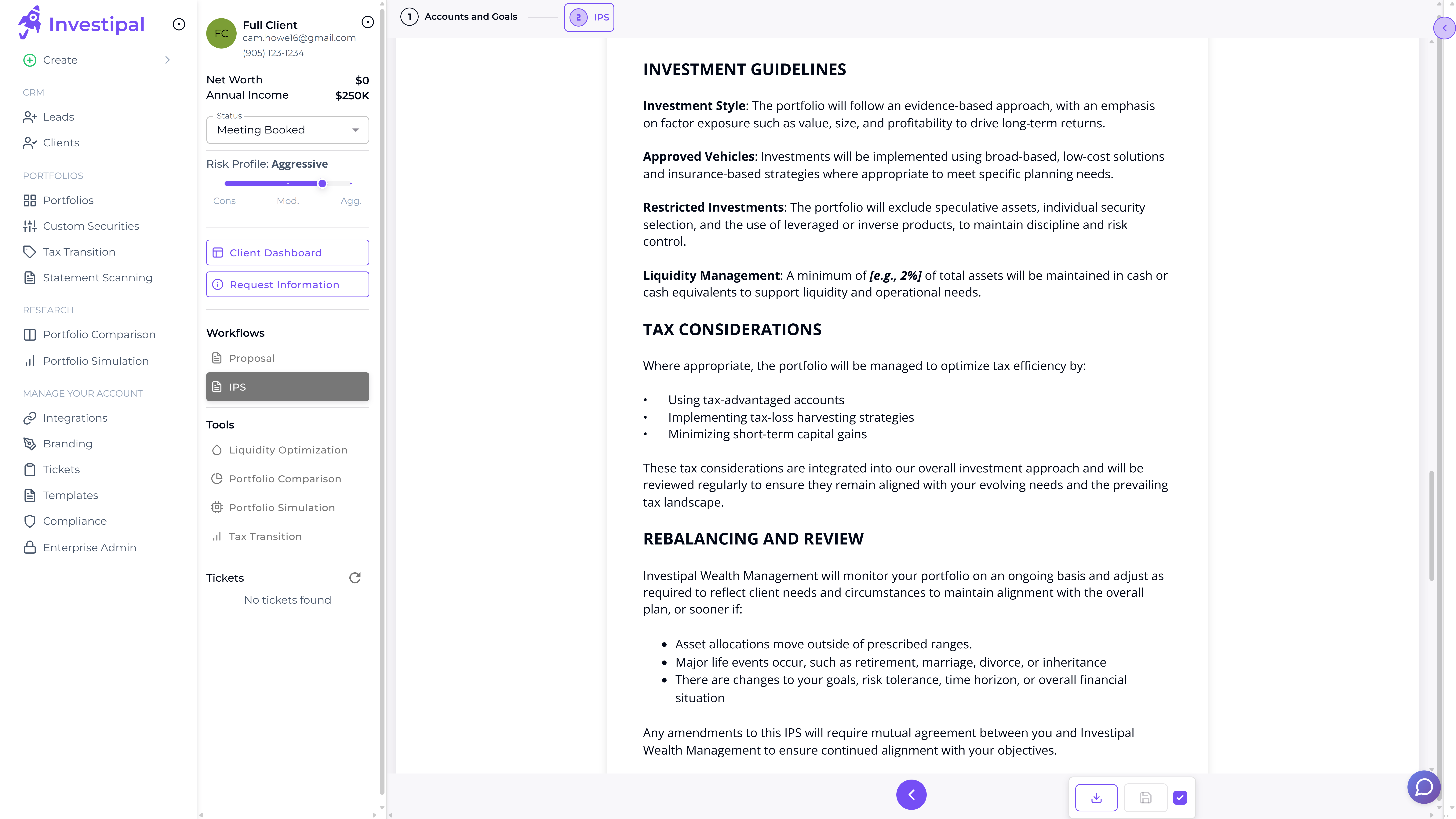

- Compliance documentation: Automated generation of IPS, Reg BI disclosures, and audit-ready risk reports

- Client-facing reports: Clear, jargon-free risk visualizations you can share with clients

- Workflow integration: Seamless connection to your CRM, portfolio management, and proposal tools

The 9 Best Portfolio Risk Software Tools for Advisors in 2025

1. Investipal — Best for End-to-End Risk, Proposal & Compliance Automation

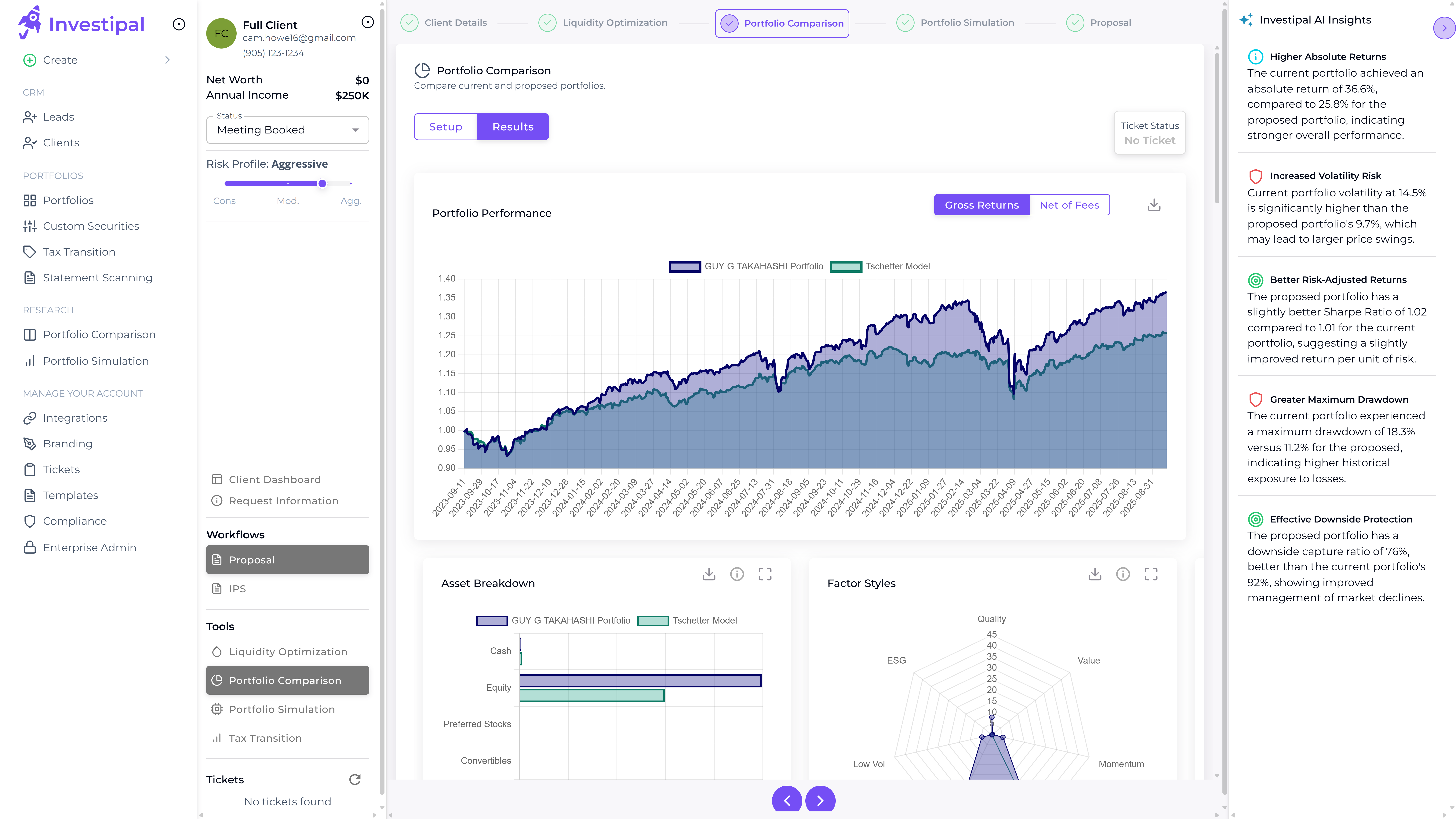

Investipal stands apart by combining portfolio risk analysis with proposal generation and compliance documentation in a single platform. Instead of toggling between tools, advisors get a unified workflow from client intake to compliant recommendations.

Key Portfolio Risk Features:

- AI-powered risk scoring that analyzes behavioral risk tolerance alongside actual portfolio exposures

- Real-time drift monitoring with automated alerts when portfolios deviate from IPS guidelines

- Concentration risk detection at the underlying position level—identifying overexposure in individual holdings

- Stress testing and scenario analysis (2008 crisis, COVID crash, rising rate environments)

- Held-away brokerage account linking for a consolidated view of client assets

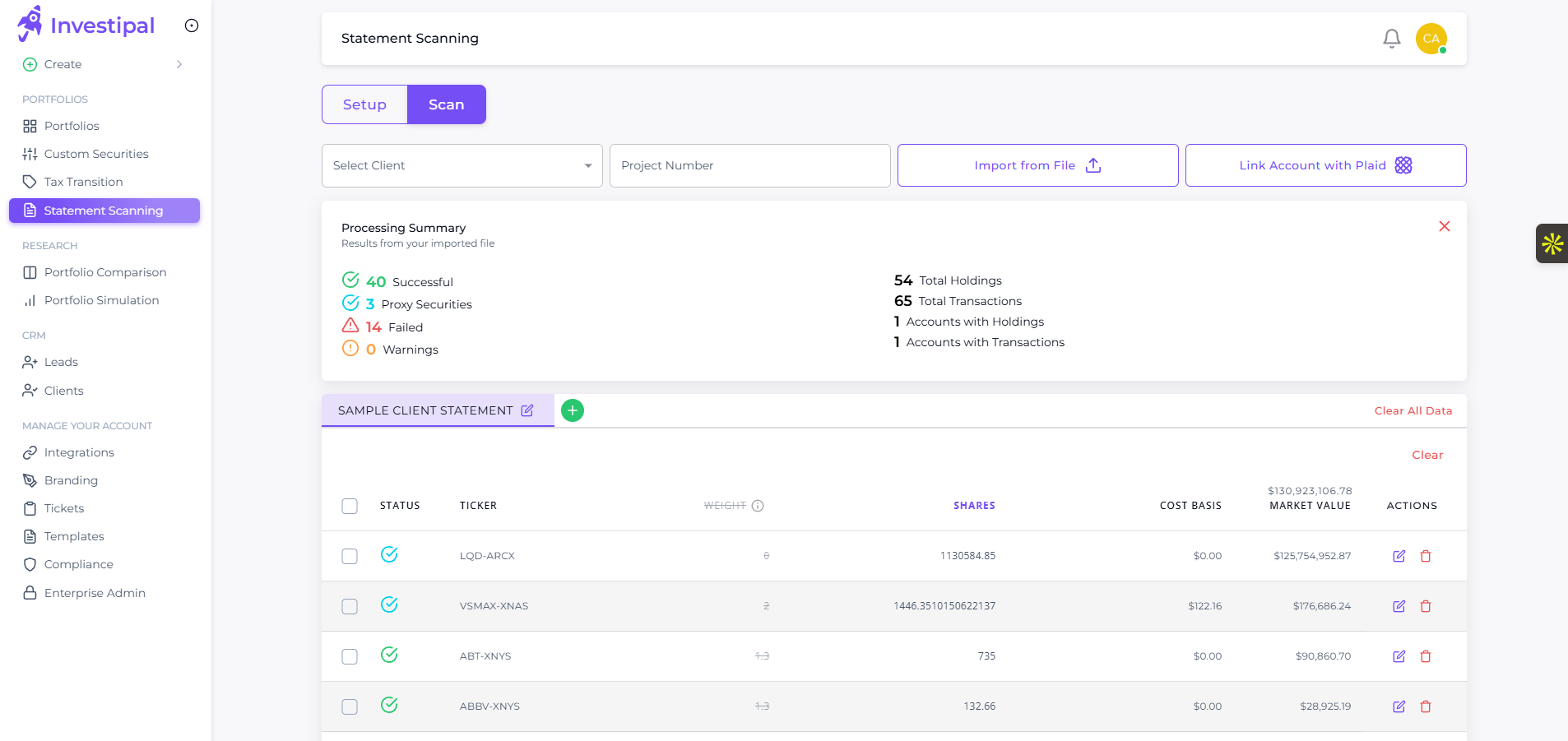

- AI statement scanner that ingests any brokerage PDF and extracts holdings automatically

- One-click generation of Reg BI documentation and Investment Policy Statements

Best For: RIAs and advisors who want portfolio risk analysis that flows directly into proposals and compliance docs—eliminating manual handoffs and reducing onboarding time from days to minutes.

Book a demo to see risk automation in action.

2. Nitrogen (formerly Riskalyze) — Best Known for Risk Number Scoring

Nitrogen pioneered the "Risk Number" concept—a 1-99 score that quantifies client risk tolerance and portfolio risk alignment. The platform provides a portfolio-wide Risk Number and 95% Historical Range to help advisors make investment decisions and demonstrate alignment to prospects and clients.

Key Features:

- Risk Number scoring for clients and portfolios with 95% Historical Range

- Stock Intersection feature that identifies overlapping securities across accounts

- Retirement maps showing probability of success

- Check-ins to monitor risk alignment over time

- Tools for documenting suitability

Limitations: Nitrogen focuses primarily on risk tolerance and alignment. The platform has expanded into a broader "Growth Platform" offering that includes lead generation and client engagement tools.

Best For: Advisors who primarily need risk tolerance questionnaires and risk number communication with clients.

3. YCharts — Best for Investment Research with Risk Analytics

YCharts combines institutional-grade investment research with portfolio risk analytics. The platform offers comprehensive fundamental and technical data alongside portfolio analysis tools, making it strong for advisors who want deep security-level research.

Key Features:

- Fundamental and technical data on thousands of securities

- Portfolio Optimizer for identifying optimal asset allocation at given risk levels

- Risk metrics including Sharpe ratio, Sortino ratio, max drawdown, and VaR

- Stress Test feature to model portfolios against economic scenarios like market downturns

- Client-ready reports and charts

Limitations: YCharts excels at research and analytics but doesn't include compliance documentation, proposal generation, or onboarding automation. It's a point solution that requires integration with other tools.

Best For: Research-focused advisors who want deep security-level analysis and are comfortable building their own workflows.

4. HiddenLevers — Best for Scenario-Based Stress Testing

HiddenLevers specializes in scenario analysis and stress testing. The platform enables advisors to test portfolios, households, or accounts against various economic scenarios interactively—from interest rate shocks to geopolitical events.

Key Features:

- Pre-built economic scenarios for stress testing investment portfolios and structured products

- Interactive stress testing with visual impact analysis

- Proprietary risk tolerance survey

- Scenario planning tools for client conversations

- Client presentation reports

Limitations: Focused specifically on stress testing and scenario analysis. May require additional tools for comprehensive compliance documentation or proposal generation.

Best For: Advisors who want to demonstrate portfolio resilience during client reviews and need sophisticated scenario modeling capabilities.

5. Orion Risk Intelligence — Best for Orion Ecosystem Users

Orion Risk Intelligence combines business intelligence, risk analytics, and economic research to guide clients toward investment recommendations. It integrates tightly with Orion's portfolio management platform, offering customized portfolio recommendations and stress testing scenarios.

Key Features:

- Risk tolerance assessment and scoring

- Customized portfolio recommendations based on risk profiles

- Stress testing scenarios to address macro concerns

- Proposals that illustrate the reasoning behind recommendations

- Integration with Orion Portfolio Solutions

Limitations: Best suited for firms already in the Orion ecosystem. Standalone functionality may be limited compared to purpose-built risk platforms.

Best For: RIAs already using Orion who want integrated risk tools without adding another vendor.

6. Kwanti — Best for Accessible Portfolio Analytics

Kwanti delivers a complete portfolio analytics platform for model construction, portfolio reviews, and proposal generation. Trusted by thousands of advisors daily, it combines powerful analytics with an elegant user interface.

Key Features:

- Monte Carlo simulations and probability of success

- Risk/return optimization tools

- Drawdown analysis and historical stress testing

- Factor exposure analysis

- Client reports and proposal generation

Limitations: Primarily analytics-focused. May require additional tools for statement scanning or held-away account integration.

Best For: Advisors who need solid portfolio analytics with an intuitive interface for model construction and client presentations.

7. Addepar — Best for Ultra-High-Net-Worth and Multi-Asset Families

Addepar is built for complex wealth—family offices, UHNW clients, and advisors managing illiquid alternatives alongside traditional portfolios. The platform handles asset classes and reporting complexity that most tools can't accommodate.

Key Features:

- Unified view across public, private, and alternative assets

- Customizable risk factor models

- Liquidity analysis for private holdings

- Concentration and correlation risk at the household level

- Enterprise-grade reporting and client portals

Limitations: Enterprise-focused platform with significant implementation requirements. May be more than needed for advisors without significant alternative asset exposure.

Best For: Family offices and RIAs managing complex, multi-generational portfolios with significant alternative investments.

8. PortfolioAnalyst by Interactive Brokers — Best Included Option for IB Users

Interactive Brokers includes PortfolioAnalyst for clients. It provides risk analytics and reporting for portfolios held at IB, plus the ability to link external accounts for a consolidated view.

Key Features:

- Risk metrics including volatility, Sharpe ratio, and benchmark comparison

- Portfolio allocation analysis

- Performance attribution

- Ability to link external accounts for consolidated view

- Tax lot optimization tools

Limitations: Basic compared to purpose-built advisor tools. No compliance documentation, limited client reporting features, and no proposal generation.

Best For: Advisors who custody at Interactive Brokers and want risk analytics included with their custody relationship.

9. BlackRock Aladdin Wealth — Best Enterprise Solution for Large Institutions

Aladdin Wealth brings BlackRock's institutional risk management technology to the wealth management space. It leverages the same risk models used by the world's largest asset managers.

Key Features:

- Institutional-grade risk models

- Real-time portfolio monitoring and alerts

- Scenario analysis across thousands of factors

- ESG risk integration

- API-first architecture for custom integrations

Limitations: Designed for large enterprises, not independent RIAs. Implementation requires significant resources and dedicated technology teams.

Best For: Large broker-dealers, banks, and enterprise wealth management firms.

Portfolio Risk Software Comparison Table

| Platform | Best For | Held-Away | Compliance Docs | Proposal Generation |

|---|---|---|---|---|

| Investipal | End-to-end automation | ✅ Brokerage accounts | ✅ IPS, Reg BI | ✅ |

| Nitrogen | Risk Number scoring | Limited | Partial | Limited |

| YCharts | Research + analytics | ❌ | ❌ | Limited |

| HiddenLevers | Stress testing | Limited | ❌ | ❌ |

| Orion Risk Intelligence | Orion users | Via Orion | Partial | ✅ |

| Kwanti | Accessible analytics | ❌ | ❌ | ✅ |

| Addepar | UHNW/alternatives | ✅ Full | Partial | Limited |

| IB PortfolioAnalyst | IB custody clients | ✅ Account linking | ❌ | ❌ |

| Aladdin Wealth | Enterprise | ✅ Full | ✅ | ✅ |

Why Most Advisors Are Switching to Integrated Portfolio Risk Platforms

The trend in 2025 is clear: advisors are moving away from point solutions toward integrated platforms that combine portfolio risk analysis with proposal generation, compliance documentation, and client reporting.

Here's why the shift is happening:

1. Fragmented Tools Create Compliance Gaps

When your risk tolerance questionnaire lives in one tool, portfolio analytics in another, and compliance documentation in a third, data falls through the cracks. Inconsistencies between systems create exactly the kind of gaps that regulators flag during audits.

2. Manual Handoffs Waste Hours Per Client

Every time you export data from one system to import into another, you're adding manual work and error potential. Advisors report spending 3-5 hours per client on data wrangling that integrated platforms eliminate entirely.

3. Real-Time Monitoring Requires Unified Data

You can't set up meaningful drift alerts or concentration warnings if client assets are scattered across disconnected systems. Platforms that consolidate portfolio data provide the complete picture needed for proactive risk management.

4. Clients Expect Seamless Experiences

Today's clients compare their advisory experience to fintech apps. They expect real-time portfolio visibility, clear risk communication, and fast onboarding—not multi-week processes that require faxing statements.

How to Choose the Right Portfolio Risk Software for Your Practice

Consider these factors when evaluating options:

- Practice size and complexity: Solo advisors have different needs than multi-advisor firms with compliance teams

- Client asset complexity: Do you manage significant held-away assets, alternatives, or concentrated positions?

- Existing tech stack: Will the tool integrate with your current CRM, custodian, and reporting platforms?

- Compliance requirements: Do you need automated IPS generation, Reg BI documentation, or audit trails?

- Implementation timeline: How quickly do you need to be up and running?

Getting Started with Portfolio Risk Software

If you're evaluating portfolio risk management tools, start by mapping your current workflow:

- Document your pain points: Where are you spending the most manual time? What compliance gaps concern you?

- Define must-have features: Based on your client base, what capabilities are non-negotiable?

- Request demos from 2-3 vendors: See the tools in action with your actual use cases

- Evaluate total implementation effort: Include training, integrations, and workflow changes

- Start with a pilot: Test with a subset of clients before full rollout

See Portfolio Risk Automation in Action

The right portfolio risk software doesn't just analyze risk—it transforms your entire client workflow. From the first prospect meeting through ongoing monitoring and compliance, integrated platforms eliminate the friction that slows down your practice.

Investipal combines AI-powered portfolio risk analysis with statement scanning, proposal generation, and compliance documentation in one platform. Advisors using Investipal report:

- 95% reduction in manual data entry

- 10x faster client onboarding

- Automated drift alerts and concentration warnings

- One-click IPS and Reg BI document generation

Ready to see how modern portfolio risk software can transform your practice? Book a personalized demo and we'll show you exactly how Investipal handles portfolio risk analysis for advisors like you—from prospect to proposal to ongoing monitoring.

.png)